![]()

Republished 10/12-15/2021 Added charts, added topics, fee table, additional facts.

It's that time for a new association budget. I've posted many times here about budgets, the process to prepare them and a few issues that I faced on the board. My posts have included some things to be considered when constructing budgets.

I talked until I was blue in the face to educate boards 2011-2018. I created lots of spread sheets. A few of the earlier charts shared with owners and boards are included here.

I post this as an aid to avoid the mistakes of the past. (Note 8, 9).

What is the Budget Meeting?

The budget meeting is an annual event, usually held in October. During the meeting the entire board determines the budget for the following year. The board sets the fees required to achieve that budget. The fees may increase, decrease or remain the same.

The meeting is of only about 2 or 3 hours duration. It is open to owner observation. It is the culmination of work by management and other board members.

In fact, I spent hundreds of hours each year on budgeting and related tasks. Those tasks included the hours required in preparing and reviewing reserve studies, supplemental spread sheets and reports.

The actual budget meeting was a formal meeting was a review of the budget requirements and a discussion of how to deal with the costs anticipated to occur in the following year. It was a business meeting and should be conducted as one.

Personal agendas and emotions including fear should be checked at the door by board members. It should be replaced by their fiduciary responsibilities and simple business sense. For some on the board constructing budgets is like an Olympics for which they are ill-prepared. God help the owners who elect boards based upon the pap in the Candidates Form. But then, owners do get the board that they elected. And they get the results, the maintenance (or lack thereof) and the fees.

How to avoid emotions? Run the numbers and prepare the spreadsheets. However, not all board members are swayed by facts.

About special assessments. If special assessments were required, that determination would have been made prior to the budget meeting. However, some board members would dangle that specter during the budget meetings. I concluded that was a manipulative ploy using fear to run an agenda and promote fee increases. I prefer working with the

numbers; that’s what fiduciaries should do.

I've included a table of fees (Note 6 ). Earlier fees and some of the budget discussions failed to

distinguish the requirements of the O&M budget and those of the Replacement Fund.

Separating the Budgets

One of the things I did was to separate the amounts and percentages of fee changes into two categories: Replacement Fund and Operations & Maintenance Budgets. I tracked the amounts and percentage of each of these categories independently. That is how I know the dollar amount and the percentage of the budget allocated to the Replacement Fund. I may publish that here in a future post. Boards were provided with the amounts each year and decided what they were to be via the budgeting process. Each board member could have run their own numbers each and every year. I did give my charts, etc. to the board and while on the board I did discuss this thoroughly and completely with the entire board.

On a positive note, a portion of higher O&M fees may have flowed into reserves if there was a surplus. How is that? Read on. I have an opinion that boards did flush owner fees by avoiding such things as stream maintenance, which resulted in larger water usage. Yes, that water did eventually find its way under buildings and to the water table. I say it contributed to some expensive maintenance problems. It was addressed as the roofing project wound down.

Prior to October 2010 boards failed to distinguish between the requirements of the O&M budgets, and the Replacement Fund, and provide owners with that information as percentages of the budget. Emphasis was on budget increase percentages to fees. This is why, in 2006 owners began to clamor for more transparency. A previous lack of formal reserve studies blindsided a new board in 2009.

I made it a point, commencing with a board position in September 2010 to provide transparency.

|

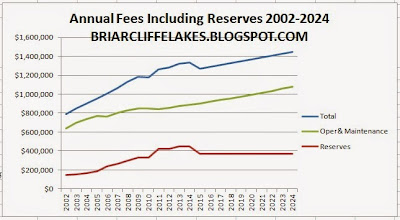

| Annual Fees Including Replacement Fund and O&M Budgets |

Budgeting is a normal exercise in business.

Good budgeting is not an easy task. By "good" I mean accurate budgets that avoid excessive surpluses and deficits. Constructing good budgets requires a lot of background work. It required many, many hours of my time each year.

It is true that boards will attempt to avoid deficits. So shouldn't they also track surpluses? In fact, I've observed an emphasis about avoiding budget shortfalls. I think this emphasis can be traced to the problems of early budgets at BLMH. Fees gyrated wildly, and then the board began accumulating funds for large projects. In fact, for a time reserves were underfunded. My accountant flagged that when I considered a purchase in 2001.

The real purpose of budgeting

I say, Budgeting is based upon fact and is a means to manage the fees extracted from owners. It is a creative exercise which has factual and philosophical underpinnings. It may be distorted by the emotions or positions of some board members. Those board members, if fearful of a special assessment, are easily manipulated by others. Those board members, if disdainful of owners, may be inclined to favor higher fees than required by the facts.

"Do you want to avoid a special assessment? Then vote for my 5% increase. "

Those in fear on the board are are so easily manipulated, and they have been. Owners deserve better but pretend they are living in a apartment, and expect others to protect their financial interests in the HOA, because those on the board are elected volunteers.

Some board members view it as an exercise of "Good versus bad" or "Right versus wrong" and some see it as a means solely to avoid special assessments.

In this post I'll merely summarize and provide a few notes, including a table of annual fee increases. This post includes a review of methods, surpluses and what to do if there are deficits and O&M expenses exceed fees collected.

In fact, the budget process at BLMH has improved significantly since 2010. So much so that in recent years even with modest fee increases annual surpluses were created. What happens to those surpluses? Read on.

Why a Budget?

The Illinois Condominium Act requires that HOA boards prepare an annual budget, submit it to owners for comment, and in consideration of such comments the board votes to approve or alter the budget.

The budget is essential to maintain the association and pay the day to day bills. It also includes a Replacement Fund for reserves to address longer term infrastructure repairs.

The two aspects of the budget are the Operations and Maintenance (O&M), and the Replacement Fund.

In fact, the board has quite a lot of latitude, but for some it is ithe eqivelant of the Olymics when contructing a budget. An Olympics for which they are unprepared.

Operating costs from previous years history are an aid for construction the O&M portion. There are those who resist this, and prefer to avoid the history of the association. Matching their years on the board to the budgets and the reserves accumulated may indicate why.

There are reasons and then there is "Why".

Professionally prepared, independent Reserve Studies are essential to the Replacement Fund portion. However, these are only guides. The board makes all of the decisions, as fiduciaries and are to operate in the best interests of the owners.

Under all circumstances, boards must be mindful of the financial capacity of the owners. The Illinois Condominium Act (ILCA) stipulated that in the preparation of budgets the board must consider "the financial impact on unit owners, and the market value of the condominium units, of any assessment increase needed to fund reserves." (Note 1). This was a serious budget consideration by the boards of 2010-2018.

I want to note that Reserves Studies may provide a a worst case scenario which are unrealistic. Some board member will use that to promote their personal agenda. Boards must set priorities and construct budgets in such as manner as to be in the best interests of the owners. That was my guiding light. Boards 2010-2018 did strive to operate the association within the budgets.

A failure to do so will spend more money than necessary, requiring higher fees. This cycle will continue indefinitely unless checked by the board. At BLMH committees and management have provided input to the advisors who prepared the reserve studies 2010-2015. I was a member of these committees. The committee prepared and submitted detailed reports to boards for the budgets prepared in 2010-2017. Other committee members have included the treasurer and the maintenance director. (Note 2).

I want to point out that while I was on the board some board members argued in favor of using "The worst case scenario" when constructing budgets. I did not agree to that approach. It is the board's responsibility to avoid such a scenario and if such a situation does occur, deal with it in such a manner that does not penalize the owners. Each year I as a board member pointed to the ILCA statement above, and to others, as guidance for the board.

One board member rebuffed me with this statement about owners: "We should not cater to the lowest common denominator." I don't recall ever seeing that position on a Candidate's form leading up to any election.

In fact, boards should do their utmost to design a good budget. However, I need to add "Good for whom?" because I served with board members who placed the owners at the lowest tier.

I was on the board from October 2010 to October 2018. I was involved in constructing 9 annual budgets. The annual fees over that period increased $512 per owner (average annual), or about $51 per year. The Replacement Fund contribution during that period, excluding surpluses, was almost $4,000,000.

There were heated debates and it was because of a group led one board member who continuously argue ford even larger fee increases. I asked "Why?" I led the group arguing for modest fee increases, using fact based analysis. Because of my position I and two other board members experienced personal attacks by one board member. There were times it was facts, including numbers, documentation and historical data versus a belief system.

It is important to realize there are actually two budgets which are ultimately combined

The annual budget includes money to pay for next year’s annual

expenses, that's the Operations & Maintenance (O&M) budget. There is also money for funding the Replacement

Fund (Reserves). These are separate and

distinct.

These are to be discussed separately by the board when

constructing the annual budget. The

annual needs are then combined into a single budget.

Surpluses may be generated when the actual O&M expenses

in a year are less than the budgeted amount.

These surpluses should be recognized.

If large surpluses are generated and are ignored by a board when making

future budgets, then those boards are, in fact, levying a stealth, higher fee

to the owners. I became aware that some earlier boards didn't know such surpluses may exist. It was really about flying by the seat of one's pants.

I can state categorically that BLMH has had board members who refuse to acknowledge the existence of surpluses when constructing the budget. Their mantra is “There is never enough money”. I have a different perspective. I say “Boards will spend every dollar levied on owners.” In other words, owners should be mindful. and provide proper oversight the the board.

For the 2019 budget the fees extracted from owners were increased by the board, even with the facts of a large surplus, noted in the beginning of this post. I objected formally via email. My spreadsheets and supporting documents were ignored and the entire board voted for a fee increase. I must ask and I did, "What is the factual basis for a fee increase?" I did not receive a meaningful response. Most CYA responses by management are "I have forwarded this to the board". LOL. But I cannot fault management because it is the board that made the decision. I can fault a board, which hides behind management.

All sources of Income need to be considered

The budget includes projected income. That income assumes

that all owners will pay their fees and that all fees will be collected. In the short-term, the owners may be in arrears by $30,000, or more. That was included in the Newsletter to owners In December 2008. The new board, after my departure has not provided his information to owners, and when asked during the September 20121 board meeting they stammered and stonewalled.

In fact, some fees owed the association may never be collected. There is a contra account for that. This is an amount subtracted from income to

account for fees that may not be collected and will be “bad

debt” which is uncollectible debt for the association.

Other sources of revenue include legal fees collected and fines. Of course, an association should not levy fines

as a means to generate revenue. Fines are a means to obtain rules compliance

from owners. I've listened to one board member during a budget meeting who bragged about the amount of fines collected, as if it were a wonderful accomplishment.

The contra account is useful when determining if surpluses or shortfalls occur in a yearly budget.

Budgeting is an educated guessing game, with really serious consequences for owners

One thing to understand is that budgets are based upon projections. One part, the Operations & Maintenance budget, has short term implications. Problems that occur in one year can be corrected, improvements made and addressed in the next year. However, costs are always changing. There may be utility price increases and so on.

Budgeting, therefor is also a learning experience. Boards should approach this rationally and keep their emotions in check. In depth, annual financial analysis beyond the framework of a budget is very helpful. The charts in my blog, and this post, were part of hundreds of spreadsheets I created and provided to the owners and the board to provide better insights, better forecasts and most importantly, better budgets.

Were the O&M budgets while I was on the board, better budgets? Well, I was able to document consistent and sometimes large surpluses. But to achieve this required a step change of improvements in maintenance. Better O&M controls contributed to better budgets and that was ultimately translated into lower fee increases for owners.

The Replacement Fund portion of the budget, which funds reserves, is a much longer term exercise. The reserves studies I participated in were a 40 year projection into the future. Boards should be mindful that this year’s budget may have long term implications. On the other hand, because reserves are long term financial buckets, they can have less influence on overall annual budgets. At BLMH when I tendered a bid to purchase my unit in 2001 the replacement funds were about 14.5% of the annual budget. From 2015-2017 during the period I was on the board the replacement funds peaked at nearly 36% of the budget.

Avoiding Smoke and Mirrors

As an example, I provide this. Once I achieved a seat on the board and began analyzing past budgets, interviewing contractors and management, etc. I discovered that one of the techniques used by boards prior to 2009 was to roll maintenance hours which exceeded the budgeted allotment into the next year.

That kicked the can down the road, and hamstrung any board that followed. The budgets were apparently sometimes balanced this way. It worked, I guess. However, fees from 2001 to 2009 increased nevertheless by large annual amounts. Postponed maintenance and deficient reserves can overwhelm any budget.

Management prepares a template of the O&M budget which includes the previous year's data, the current year's data as of September 30, and a projection to year end. As a board member I did a lot of supplemental research each year including determining Utility cost increases, reviewing contract dates and so on. This was appended to management's budget spreadsheet and became an important part of the board's budget decision making process.

I suggested adding a contra account item to recognize uncollectible fees. Management can explain that to the board. The president at the time, a CPA, agreed and after board discussion it was added. The boards of 2019-2020 zeroed the amount, even though the balance sheet indicated that contra amounts do exist. Is this important? It's only a few thousand dollars, but $4,000 is about $12 per owner.

These small things add up.

One of the things I began doing was tracking surpluses so they could become part of the annual budget discussions. The chart above provides an indication of the magnitude of some of these.

In constructing a budget it is essential to establish a baseline. That is, determine as accurately as possible the expenditures for the coming year. This included O&M and adjustments to the replacement fund in recognition of current and identified circumstances.

Past reserve studies have included things that did not occur and were averted by boards that chose a different approach. In doing so, special assessments, fees increase of 10% and so on were averted.

Does the budget include estimates?

Yes it does. For example, the water used by the association is a variable. Each utility closet for 4-units includes 5 water meters. One of these is for the association use, including outside spigots. The water will be used to replenish streams and for watering replacement grass, sod, shrubs and trees. It is not possible to predict how much water will be used next year. Water rates need to be adjusted if the city anticipates an increase in the following year.

Electricity for outside lighting, the hallways and the garage interiors is based upon the previous year's billing and rates. I investigated potential rate hikes each year. The electricity consumption also was based upon a prohibition of using common area outlets (garages) for electric cars and other unusual usage.

Snow removal is via contract. However that contract anticipates a certain amount of snow and ice. If there is unusual snowfall in the next year, the costs will increase. Ice requires additional work on streets, driveways and building entries. Walks are not maintained or cleaned in the winter months, which is why I added large caution notices to the newsletters. A board could choose to clean those walks at significant annual expense and in so doing the association would take on additional liability for falls and injury.

Boards consider these and other estimates to construct the budget.

Annual Replacement Fund Adjustments

Contributions to the Replacement Fund may be adjusted in recognition of unusual circumstances not anticipated in the Reserve Study. For example, the condition of trees has resulted in an additional amount each year to address this. There is no special category in the Landscaping to address the redoing of the property entrances, or the area along the frontage at 1825-1827 Lakecliffe. The existing category amounts may be adequate for replacement of dying shrubbery throughout the property, maintenance of shoreline, etc.

The information in the reserve studies should be a component in the board annual review of the contributions to the Replacement Fund. However, the board has great latitude in this, as previously mentioned here. Some boards do not conduct such reviews.

A failure to turn over the water mains to the city may require future boards to increase fees to accommodate the costs of total replacement. The current board includes several members who were briefed thoroughly by me about this when I was on the board.

Does the budget include a surplus?

Yes, some do. For the O&M budget 2011-2018 I advocated using the baseline, and then adding amounts to specific categories to deal with unknowns. I would prepare a modified version of Management's spreadsheet with notes and suggestions for adjustments, Some categories were increased by the board and others decreased. Note that I was never the treasurer. I was willing to do this, I took the time and I was sufficiently capable.

The board discussed each item and category, line by line. Further adjustments were then made.

At the end of the year management provided the board with the outcome. Yes, we did accomplish surpluses in the O&M budget. Earlier boards ignored such surpluses, as did the board of 2019-2010 . Why? One should ask "What was their agenda?" Such a position has supported higher fee increases.

Boards do have the ability to make a one time, annual adjustment to Replacement fund contributions to deal with an O&M budget issue. Boards should work to stabilize fees and avoid wild gyrations. In the period

However, it would be cynical of a board to increase O&M contributions rather than properly fund the Replacement Fund contributions for the purpose of generating an apparent surplus in any year. Politicians are adroit at such machinations, and I have wondered about some board members: "How low can they go?" Of course, there should never be politics among board members in a HOA, but when there are elections at stake politics may triumph; getting a seat on the board shouldn't be about an ego.

Why design a budget with a surplus?

The answer lies in answering the question: "What happens if there is a surplus?", and the related question "What happens if the O&M budget falls short and actual costs exceed the budget amounts?".

In fact, it is impossible to design a perfect budget. Any board that claims to have done so has either been incredibly lucky or manipulated facts,

Generating a surplus is very desirable and beneficial to owners. However, a surplus should never be created artificially via higher than necessary fees. Some boards may be inclined to increase fees rather than create controls. Boards may then brag that "We balanced the budget!" But did they do their fiduciary duty?

What if there is a budget shortfall?

If the total amount of the O&M expenditures exceed the budget, then what happens is this: money is borrowed from the Replacement Fund to make up that shortfall. If this occurs, management can determine the circumstance, but the actual amount is revealed by audit.

This is not desirable, but does not constitute a crisis. Some boards feel that this could necessitate a special assessment. Not true. Nor is it a terrible event. It is undesirable and must be avoided, period. But again, by using controls, not artificially high budgets.

If O&M expense exceeds the budget, or owner delinquencies impact the budget, an automatic borrowing from reserves will occur. This is automatic because bills get paid and the funds are not segregated, but via accounting means. Management information may indicate how a shortfall occurred, but the precise amount of any borrowing will be only revealed during the audit and reconciliation. It will be addressed as part of the audit.

However, these things must be monitored and controlled within the ability of the board and in consideration of the ILCA.

At BLMH possible annual deficits may be created by the amount of fee delinquencies in any year, which is why there is a contra account in the budget. A deficit may also be created by unusual circumstance. It is important to monitor actual costs and trends.

If there is a budget shortfall, the audit will show the amount and determine repayment. Of course, if a board refuses to acknowledge the contra account category by funding it, they are pretending that all fees will be collected. This is more smoke and mirrors.

A budget surplus may create the funds to repay such borrowing with no detrimental impact to owners; i.e, no fee increases for that purpose and no long term impact on the value of reserves.

What happens if there is a surplus?

In fact, from 2011-2018 an extraordinary amount of work was put into constructing budgets that would generate an annual surplus without requiring fee increases and might create such a surplus. Improved maintenance contributed. That was a part of the improved controls. (Note 3).

In fact, information provided by management indicated that significant surpluses were generated. However, the actual amount of the surplus may not be determined until the financial audit. A table is included at the beginning of this post.

When an O&M budget surplus occurs, there are two possibilities:

- The surplus may be added to the Replacement Fund, increasing the value of the reserves.

- The amount may be returned to owners, if allowed by the Bylaws, etc.

In fact, to my knowledge at BLMH all surpluses have been put into the Replacement Fund and none explicitly returned to owners.

Some numbers in support of good budgets and good process:

1. Let's begin with older budgets, using the automatic fee increases: Annual fees from 2001 to 2008, an 8-year period, increased about $1,155 per owner per year. About $1,518,000 was collected for the Replacement Fund (Note 4, 5). The position for increases as discussed during that period before the owners was presented this way: That smaller fee increases of 3 to 5% were better than special assessments.

Actual increases were about 7.5% each year. So boards argued that smaller increases were better, but in fact, the boards levied larger increases than what was presented to owners as the basis of the board's position. In other words, the board promoted 3% annual fee increases but actually extracted 7.5% annual fees increases from the owners. I say, read those annual candidate's forms and be skeptical.

During that period the annual budgets were in the range $787,000 to $1,131,000, an increase of almost 44% over that period.

2. Using improved budget process methods. The results were achieved using annual surveys of critical and expensive infrastructure, improved cost controls, improved budget models, reserve studies, improved maintenance and establishment of priorities. All reviewed annually.

Annual fees from 2009 to 2018, a 10-year period, with new boards, increased about $511 per owner. About $4,007,000 was collected for the Replacement Fund (Note 5). Annual budgets were in the range $1,181,000 to $1,352,000, an increase of more than 14% over that period.

3. Looking at the a 5 year period with much improved budget processes. This was after adaption of several reserve study updates, further improved cost controls and infrastructure improvements to reduce O&M costs:

Annual fees from 2013 to 2018 collected nearly $2,055,000 for the Replacement Fund. (Note 5). Owner fees during that period increased by $92 per owner. Annual budgets were in the range $1,313,000 to $1,352,000. An increase of less than 3% over that period.

4. Detailed review of 2019-2021 is not possible because I lack sufficient data to do so. Here are a few earlier charts. At least three of the current board members were present during these presentation.

|

| The chart for fees indicates that fees plateaued under new boards 2008-2018 |

|

| Annual Fees Including Replacement Fund and O&M Budgets |

|

| Fees have a bearing on unit prices. Affordability is determined by Monthly Payments: Mortgage, Real Estate Taxes and HOA Fees. In fact, from 2019-2021 unit prices increased an additional 30%. |

|

| Delinquencies stabilized (c) N. Retzke 2021 |

|

| Real and Projected Fee Increases (c) N. Retzke 2021 |

Notes:

1. The Illinois Condominium Act includes this as part of the statute:

(765 ILCS 605/9) (from Ch. 30, par. 309)

(c) Budget and reserves.

(2) All budgets adopted by a board of managers on or | ||

|

2. A number of boards including 2010 and 2014-2018 did an extraordinary amount of work on Reserve Studies. In fact, 2010 was the first year such a study was prepared by an outside firm. An extraordinary amount of work was undertaken by a board committee in the period leading up to 2017. That committee was comprised of the president, treasurer and maintenance director. It was intended to prepare information for board discussion for the advisors, so that an update could be prepared in 2017-2018. However, disruption of the budget meeting in fall of 2016 by a board member prevented discussion during that meeting and information was tabled until 2017.

3. The association uses an extraordinary amount of water for the streams and for the grounds including trees, grass and other landscaping. A lot of water was being lost in the streams, which were in serious disrepair. One was nothing more than a muddy gulch and others had numerous large cracks. Wooden bridge and deck supports ran through the concrete and were underwater, contributing to additional water loses and maintenance. A large quantity of water was being lost. This damaged some garages and created other issues. Stream repairs included concrete deck supports which reduced water loss. Stream and pond repairs closed most of the cracks which lost water. Replacement of a pump discharge line further reduced water loss and reduced the mud. These things combined should decrease water consumption and that means lower utility bills. Replacing wooden supports means those unit decks will no longer fall into the streams, etc. Maintenance hours and costs should be reduced for this.

4. Budgetary numbers are from spreadsheets I constructed from information provided by management. Delinquencies were per financials and until 2019 the treasurer would discuss the amounts during the open session of the monthly meetings. Prior to 2019 the dollar amounts were occasionally published in the official newsletters. All owners are given a budget sheet each year. In the past, management also provided owners with balance sheets and the Treasurer would provide summary data during meetings and in the newsletters. This practice was suspended by the board of 2019. As a board member I was given monthly financial data by management, as were all board members. This included a balance sheet as well as income and expense information. Audits are completed by an accountant, but audited information requires time to prepare and is delayed by a year or so. Getting any financial information beyond the budget which is published is very difficult. For example, during the September annual meeting an owner asked about delinquencies and bank balances. The board could not answer the question. That is why financial information for 2019-2021 is not included here.

5. Fee numbers per owner are simplified as the fees divided by the number of units. If fact, the fees per unit are determined by percentage ownership and not all units have the same number. That percentage was determined by the builder and is a part of the Bylaws and Declarations of the HOA. If all ownership was uniform, each owner's fees would be 1/336 or 0.2976190476190476% of the total of fees levied each year.

6. A table of fee increases, by year. Note that budgets and fees are determined by the board during a budget meeting held normally in October. In other words, the budget for 2019 was determine by the board elected in September 2018. I included some notes. For example, a reserve study in 2010 impacted the budget and fees of 2011. I departed the board as of September 28, 2018. Owners are allowed to comment on budgets prior to formal vote and passage by the board:

Year and Percent Fee Change

1978 +35.0

1979 +22.0

1980 +26.0

1981 +25.0

1982 -12.0

1983 0.0

1984 +10.0

1985 0.0

1986 0.0

1987 +5.0

1988 0.0

1989 +12.0

1990 +5.0

1991 0.0

1992 0.0

1993 +6.0

1994 +3.0

1995 +4.0

1996 +5.0

1997 +3.0

1998 +3.0

1999 +11.0

2000 +11.0

2001 +9.0

2002 +6.0

2003 +7.9

2004 +6.5

2005 +5.8

2006 +5.4

2007 +6.0

2008 +5.5

2009 +5.1 (New board September, new 2010 budget)

2010 0.0 (I joined the board September 2010, after completion of reserve study)

2011 +7.0 (First reserve study used to determine; study flawed)

2012 +3.0 (Subsequent reserve study used)

2013 +2.0

2014 +1.0

2015 -2.0 (Updated reserve study)

2016 +1.5

2017 +1.5

2018 0.0 (my last year on the board)

7. Here is a link to more than 40 earlier posts.

Click for link to: Budgeting Posts

8, This process would be so much easier if board members checked their personal agendas and baggage at the door. To take their personal agenda further, at least one board member has threatened management with dismissal if they didn't comply. How do I know that? Because that board member bragged to me about their power to do so.

I have not posted most of the melodrama or animosity I had to endure while preparing budgets and on the board. I am not a therapist nor am I a financial counselor. As a board member I was not required to assess the source of the fear of board members when they were confronted with the discussion or possibility of special assessments. At times some board members stated that if a specific fee increase did not occur, then special assessments would occur. In fact, I say the best way to avoid special assessments is proper, but not excessive, maintenance and proper budgets which include adequate reserves. To do this means good reserve studies properly updated. Yet, the first formal study completed by an outside firm did not occur until 2010. Some boards made this process far more difficult than it should have been.

9. According to the Bylaws, the board can enact fee increases up to 15% with no need to listen to or accept any owner input or comment. The bylaws state "If an adopted budget requires assessment against the Unit Owners in any fiscal or calendar year exceeding one hundred fifteen percent (115%) of the assessments for the preceding year the Board of Managers, upon written petition of Unit Owners with twenty percent (20%) of the votes of the Association filed within fourteen (14) days of the Board action, shall call a meeting of the Unit Owners within thirty (30) days of the date of filing of the petition to consider the budget.

10. The over zealous scheduler published an incomplete version. This was updated and re-published at 3:00am 10/12/2021

(c) N. Retzke 2021

No comments:

Post a Comment

Please leave a comment!

Note: Only a member of this blog may post a comment.