Summary

There is a tangible benefit to improved planning. We have more to do. The question remains who will do this? Will it be a board priority and will the board then allocate the necessary resources to get it done? I say this HOA continues to operate from a planning perspective on a year by year basis. That is not realistic nor is it adequate. If we simply adjusted project schedules and collected an annual amount equivalent to the average fee required to support reserves for the next 10 years, I am of the opinion our monthly fees would actually decrease. We need to establish a new baseline for fees and we need better annual capital project cost accounting, including percent completed, percent remaining, dollars spent to date to achieve completion and dollars required to complete.

Hint: Click on images to enlarge

This post presents the problem and a solution. We need to establish a new baseline for fees and we need better annual project cost accounting, including percent completed, percent remaining, dollars spent to date to achieve completion and dollars required to complete. We also need to carefully monitor expenditure of Operations & Maintenance budget hours for capital improvements. Mis-allocation will result in higher or lower than necessary fees. Most likely higher. Why do this? We need fees that are realistic for the identified needs of the HOA and we need to avoid stressing owners.

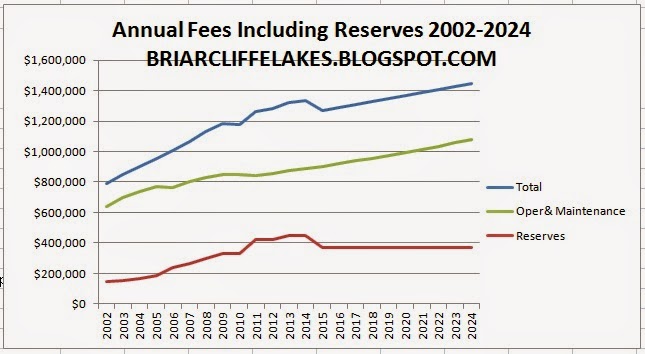

Chart 1:

The chart above indicates the allocation of fees since 2002. It's readily apparent that a substantial part of the fee increases is attributable to funding of reserves. It wasn't until 2005 that the reality of the costs of the infrastructure replacement hit home at BLMH. Yes, the boards of 2000-2005 did increase annual reserve funding from $148,000 to $185,000. But in 2006 the amount collected and contributed to reserves hit $240,000 and that requirement did have a real impact on owner fees. To fund reserves, fees had increased about $23 per month.

For the first 26 years of this HOA the contribution for the "replacement fund" or "reserves" via fees was apparently less than about $35 per month per owner. In 2002 the average monthly fee for reserves had increased to about $36.73 per owner. It then increased with leaps and bounds at an average rate of about 10% annually from 2002 to 2014. After 12 years of increases the amount contributed by the average owner per month toward reserves has reached about $111.17. Fees put into reserves has tripled since 2002. During that same time Operations & Maintenance budgets had increased only 39%.

Chart 2:

Annual Fee Increases For Reserves Have Not Been Stable

The above chart shows the annual fee increases attributable to Reserve collections from 2002 to 2014. Now, reserves are supposed to be a long term component of fees. In other words, reserves are supposed to accumulate over decades so that things such as streets, roofs and so on can be replaced. Many of these "things" have normal life spans of 15 to 25 years. In other words, it should be possible to predict the amounts to be collected each year so that the appropriate reserves can be saved and special assessments can be avoided. There are exceptions. It is difficult to predict the life span of certain aspects of infrastructure, such as water mains and sewers.

Considering that infrastructure replacement is a long term thing, it should be possible to smooth the amounts contributed to reserves. Reserve studies look ahead 30 years. Of course, if there is no reserve study collections are probably achieved via educated guesses. Another problem may be a reserve study that is truncated and incomplete. In either circumstance funding of reserves will also be incomplete. On the other hand, it's possible to over do it. There is a very real benefit to owners if the management and the board uses a well prepared reserve study and develops realistic, definitive plans from that study. That is precisely what I have been advocating.

Benefits of Long Term Planning and Stable Reserve Funding

One benefit is have the funds available to do the necessary work when the funds are needed. Another is the ability to communicate these plans to the owners, who are the shareholders in the HOA. Small incremental increases are easier for owners to manage via their personal finances. Another benefit is the lowest possible fees for all owners, today, tomorrow and 10 or more years into the future. The Illinois Condominium Act states that all owners are to be treated equally. I take that to mean current and future owners. In other words, fees should be smoothed and realistic so that everyone pays a fair share. Of course, some HOAs may prefer targeted special assessments in combination with modest annual reserve collections.

Unfortunately, BLMH has Not Experienced These Small Incremental Increases

Bear in mind that approximate 30% fee increase for reserves in 2006 resulted in a $13.64 monthly fee increase for the average owner at BLMH. That does not include any increases for Operations & Maintenance (O&M). That $13.64 has been collected each and every month for eight years.

The year before, in 2005, the amount of the increase for reserves was about 10%, or about $4.22 per month per owner. These increases add up. In 2008 owners were irate because of the fee increases. There was a lot of talk and hot air about using handymen to maintain the complex. They really missed the elephant in the room, which was the steady increases in reserve contributions.

I'm confident that some of our owners have been stressed because their income and personal budgets have not been able to compensate for 10 years of increases. Nevertheless, our overall fees have increased about 4.5% per year (2002 to 2014). Some would say that is a modest annual increase. Perhaps, but owners have had to allocate a larger portion of their disposable income to HOA fees each and every year.

Better Way - A Work In Progress

There must be a better way. We are part of the way there, but this HOA continues to operate from year to year. That is perfectly understandable for O&M which does react to fuel increases, insurance rates, water and electrical rates and so on. But reserve contributions? We can certainly determine long term reserve requirements, and we are doing a much better job at that. But are we using the information we are being given? Do we truly have a workable plan? I say this HOA continues to operate from a planning perspective on a year by year basis. That is not realistic nor is it adequate.

For example, does this HOA annually compare the amounts collected for reserve items to the percent completed to date and then recalculate the remaining sums to be collected to complete these projects? Our boards have always emphasized O&M planning. We are beginners at project cost accounting as applied to reserves.

There is a consequence to our new awareness. In 2014 more than 33% of the fees of the typical BLMH owner went into reserves. In 2002, less than 19% was allocated to reserves. That 14% increase required an additional $74.44 average monthly fee from each owner. Yes, that 14% reserve fee difference represents a large number. As I said, these things do add up over time.

The average allocation to reserves since 2005 has been more than 29%. This HOA has collected more than $3.8 million for reserves from 2002 to the present. Most of that sum, or about $3 million has been collected for reserves in the period 2006 to 2014. More than half of the total has been collected via fees in the last 5 years. Nearly 42% has been saved, but that will probably decrease by December 31 as the bills for all 2014 projects are paid.

There are certainly benefits. Our streets are projected to be replaced in 2020-2022. That project began this year and it did not require a special assessment. It is likely the south portion of Lakecliffe will be replaced in 2016 and that other work will be done prior to 2020.

Predicting the requirements for reserves and smoothing fees is a recent thing at BLMH. Returning to Chart 2 you will notice that in 2011 the changes are approaching zero percent. You will also notice that in the prior year there was a 0% increase. That was possibly an aberration by a new board. It is very, very difficult for anyone to be elected in September and then three weeks later attend an annual budget meeting and make a valid decision. I've commented that this HOA should shift to an annual budget plan spanning from March to February or some such. This would give the board time to get "end of year" financial data together, come up to speed, and then vote the new budget. Fees would be calculated for the period July through June. I don't ever expect to see this in my lifetime at BLMH; change can be difficult.

Returning to the chart it seems that the amounts required for reserves may be stabilizing. In 2011 there was a large increase to get our reserves up to where the most recent reserve study indicated they should be.

In fact, if we simply adjusted project schedules and collected an annual amount equivalent to the average fee required to support reserves for the next 10 years, I am of the opinion our monthly fees would actually decrease.

How can that be? In 2007 our management predicted that our requirements for reserves would eventually plateau. For planning purposes it is assumed that infrastructure costs increase at an average of about 2.2% per year. In other words, once the fees for reserves match the requirements of the infrastructure of a HOA, then the annual increase for reserves should not be more than 2.2% on average. Reserves being 1/3 of or annual fees implies our reserve fees should not increase by more than 2.2% in any year.

Of course, there is always the unexpected. That could include a large insurance premium increase, a significant or unexpected infrastructure failure, a new reserve study which identifies previously unrecognized capital items, and so on. There is also the possibility that we are doing a better job on some of the larger capital projects, such as the roofs. We could come in under budget. If so, the funds not spent could be allocated to other projects. That could have a beneficial impact on owner fess. With long term O&M budget increases of about 1.1 to 3% per year, it would be reasonable to expect fees to stabilize at a new baseline. I cannot state what that baseline should be. Will it be higher or lower than our current fees? Once established, its also reasonable to assume that there will be annual increases of between 1 and 2% per year.

A Possibility of Funding Overshoot

However, for a HOA such as BLMH which collects via 10% [reserve portion] annual fee increases there is also the possibility the HOA will overshoot and collect too much. In other words, there is a real possibility that a HOA can collect more than is required. That is precisely why I pressed for a reserve study update in 2014. We are nearing the end of a major capital project. It seems the roofs will come in under budget. That includes the roofs and drainage modifications.

If we do overshoot, that will relieve some of the financial pressure by the earlier street project. However, my charts include the period through 2024 which includes completion of all roofs, streets and entryway doors, mailboxes and intercoms. In other words, we seem to be funding reserves adequately [per the 2011 reserve study].

This HOA has been ramping up fees for reserves steadily for over a decade. How much each year? About 10% more each and every year, on average. This is how we went from a reserve balance of about $300,000 to over $1.7 million, while doing the roofs, driveways and about 20% of our garage floors. However, this is a moving target. We are within three year of the completion of the roofing project and we began a major street project this year. In other words, on January 1, 2015 this HOA will probably have about $1.2 million in reserves.

One thing our management and board can do to smooth fees is adjust completion schedules for streets, etc. We're supposed to replace all of the streets 2020-2022. We began in 2014. However, if we look closely at all of the projected reserves expenditures from 2014-2022 and then collect the average amount each year while closely monitoring expenditures, it should now be possible to collect an average amount each year for each and every of the next 10 years.

What would that look like? Here is a chart which includes annual Operations & Maintenance budget increases of 2% while meeting all requirements for reserves identified in 2011. It extends to 2024. It does not include a fully realized baseline fee adjustment because at the time I prepared this chart is was unknown.

Chart 3:

What would this mean for owner fees? Here's a chart 2002 to 2024 which includes 2% annual increases for Operations & Maintenance (O&M) . In fact, for the period 2009 to 2014, the average annual fee increase for O&M budgets was 1.1% per year. Assuming a 2% annual O&M increase would be reasonable, wouldn't it? It is important to point out to the reader that the O&M budget is arrived at annually. Only reserves should be accumulated from year to year. If there is a O&M shortfall, it is possible for the board to "borrow" from reserves. That money must be paid back, and I would think it should be repaid within one year. In other words, if the board miscalculates the O&M budget by 1/2%, that would require an adjustment in the next year. How much of an adjustment? In 2014 our O&M budget was $886,827. A 1/2% error would require a $4,434 adjustment. That's about $1.10 per month per owner. My point? A 1/2% error is not catastrophic.

Chart 4:

Note:

- I am aware of the prevaling wisdom that a fee increase of 0% is not a good idea. In general I support that. After all, we all know that costs do increase each year. Long term inflation for consumers may increase the price of goods and services by 3% or more per year. However, if a HOA becomes a "supersaver" and puts aside as much as 33% toward reserves, at some time a limit will be reached. At some point in time, that HOA will be saving more via reserves than might be required.

- The reserve study update will be helpful in sorting this out. But it is not yet ready and the annual budget meeting is a few days away. What would you do?

- I have the same information available as do many of our owners. I used the information of the published budgets to determine what was happening. However, I also added the information contained in the reserve study of 2011. I also walk the property and count such things as remaining roofs and driveways and note their condition. Anyone can also walk the property and count the number of completed roofs and driveways and so on. Most owners might not be aware of the details and intricacies of the reserve reports. These things are discussed openly at HOA meetings, as are bid selection, costs and so on. I also realize that it is impractical for owners to attend every HOA meeting and take notes. So I put the funding level information here.

- There is no certainty; that is true. One of the very real fears for a HOA board is the possibility of undershooting the requirements of the budget and then either requiring a special assessment or a large fee increase in the next year. I am aware of the argument that " a 2% fee increase is better than a 0% increase followed by a 6% increase." However, I am of the opinion some of this fear is not grounded in current reality. Remember, in 2002 this HOA had about $222,000 in reserves. We were about to begin the replacement of all streets and the roofing project. The financial plan was clearly inadequate and the fears of the boards must have been real and palpable. This HOA had dug a deep, deep financial hole and it took years to fill it. "That was then and this is now." It isn't 1999. We do have reserves. We do have a bona fide reserve study and we have an update in preparation. Our current reserve study includes new entry doors for all buildings, completion of roofs, garage floors, streets, curbs, gutters and so on. All prior to 2024.

No comments:

Post a Comment

Please leave a comment!

Note: Only a member of this blog may post a comment.