I received my "official" 2010 BLMH budget via the mail. I also have a spreadsheet that was made available to unit owners who attended the January

(1) association meeting. As I stated in an earlier post, I refrained from publishing until after the board decisions had been made and after they had released their "official" data to us, the unit owners.

The association spreadsheet provides a glimpse of the proposed and actual budgets for 2004 to the present. Only "2010 budget" information was included. I assume the "actual" information for 2009 was not the audited data for the year, and so is possibly "preliminary" data.

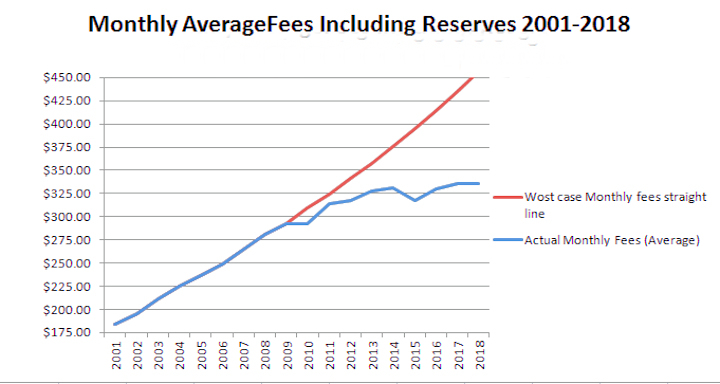

For your information, here is a chart I made of the Operational and Maintenance expense portion of the budgets.

You will notice a spike in 2009. I suspect the actual for 2009 includes the expenses for concrete, landscaping modifications, etc. which were associated with the roofing and driveway projects. As near as I can surmise, the spreadsheets do not indicate the amounts spent on reserve items in 2009; for example, roofs and driveways. Or, if they do, the amounts are buried within maintenance items. However, no clarification was provided.

One item of interest was the expenditure for "Grounds Maintenance" which was nearly 59% greater in 2009 than it was in 2008

(3). The actual difference was $16,423. This is not a trivial amount. I am not aware of the explanation for this variance. Was this a one time event? Is it related to the driveway and roofing projects of 2009? Our 2010 budget increases the amount for this category by 12.4% above the actual expenditure for 2009.

You will also note that expenditures for operational and budget items continue their upward trend. Several items of interest here. First, the budget adapted for 2010 is identical to the budget for 2009. However, the actual costs for 2009 were 3.96% greater than the budgeted amount for 2009. Nonetheless, our Board of Managers decided that the 2010 budget will not be based on the "actual" budget for 2009. So it appears to me that we may have a possible 3.96% shortfall built into the operating and maintenance budget for 2010.

Second, even though costs continue their upward trend, the board has decided to hold our monthly fees at the same level as 2009. So the question is, if costs do increase, where will the funds for any budget shortfalls come from? My guess is, from reserves if the board can find a way. Third, this budget is after the great uproar by that group called the "Residents of Change" and their vow to go over the budget and bills "item by item".

Here is a graph of our actual expenditures, with 2010 using the amount projected by our Board of Managers. You will note that the trendline is continuously upwards. From the "actual" in 2004 to the end of the trend line in 2010, the trend in increasing at 3.35% per year. However, our association is budgeting for a 0% increase in operating and maintenance expenditures in 2010. I think there will have to be a few budget cuts to accomplish that. So where will those occur? I suppose our Board assumes that the annual inflation rate, which is currently 2.7%, will have no impact on us. In other words, energy, contractors who held the line on costs last year and so on, will not pass along their costs increases to us as the economy moves out of recession and expands. All costs will be exactly the same as that budgeted last year

(2), and therefore will be nearly 4% less in 2010 than they actually were in 2009. Hmm, I don't think Com Ed is going by that play book.

Please don't make the assumption that a 4% fee increase was required in 2010 to meet rising costs. That portion of the budget allocated to operating expenses and maintenance is about 75% of the total annual budget. So, if the amount allocated to reserves is a constant amount per year, then our total budget shortfall will be about 3% in 2010, using the data provided by the Board of Managers.

According to the Balance Sheet dated November 30, 2009 as of that date, BLMH had a surplus of $6,643 for the year to date. I am uncertain if that Balance Sheet reflects the expenditures for roofs and driveways in 2009. I hope some of this becomes clearer with the balance sheet for the calendar year ending 12/31/2009. You will recall, the driveway projects for 2009 are incomplete and were scheduled for completion in 2010. Of course, our new Board of Managers may choose to go in another direction, to save funds. I understand another "reserve study" has been ordered by the Board of Managers, as announced at the January

(1) association meeting. Obviously, the board is trying to find a way out.

I'll be publishing additional information on the adapted budget and I will also be publishing my projections for the driveway and roofing projects for BLMH. I had hoped the Board of Managers would have provided us with this information but they apparently chose not to, or did not do the analysis necessary. No matter, I have done mine.

==========================================

Errors and Omissions

(1) In the original post, the December meeting was cited.

(2) In the original post, was mis-spelled.

(3) the original post compared the 2009 budget.**

**With kudos to a sharp pair of eyes!