There is a dilemma facing boards in HOAs. That is "What is the appropriate reserve level?" Determining how and when reserves will be spent is necessary to come to some reasonable answers to this question. This is a complex problem for HOAs in which the solution may span decades and many boards.

"The roof project at BLMH began as a shining example of how not to do a project." (see notes).

For example, our roofing project will require about 16 years from first roof to last. That is in fact longer duration than is prudent for this project. However, the real question is how to financially prepare for such a project. I'll use our HOA project as the basis for an example.

Let's assume the total cost of this project to be about $2,000,000, which is about $125,000 saved each year for 16 years. Why use 16 years to accumulate the necessary funds? Read on.

So how much should a board have set aside for this at the time the project begins? Of course, one should not deplete reserves for a single project. So, beginning such a project with $125,000 or less allocated to it would not be a good idea, would it? To do so would require collecting funds as the project proceeds; a sort of "pay as you go" approach. That approach would require the delay of roofs as funds are accumulated and that's what occurred at BLMH, and why a 10 year project will take about 16 years and some roofs may reach 23 years of age. At the other end of the savings range, one could delay until the full $2,000,000 for this project has accumulated in the appropriate reserve account. But that puts a large fee burden on owners for many years prior to the actual project begins.

I think we'd agree that the reality is some where between these extremes. That is a problem for boards to determine and it must be replicated for streets, driveways, garages, walks, streams, decks and so on.

Furthermore, this problem will not be solved by one or two boards. In fact, it is not uncommon to have board members turn over every other year or three or four. Some may stay longer, and some may depart after one year. So how do boards deal with multi-decade projects? How are new board members received and how are they brought up to speed? How is continuity maintained? At BLMH in 2008 we had a near complete board turnover. In such circumstances will chaos be a result? It could be. Not only are reserves and projects impacted. So too are rules and the many tasks boards are charged with completing. Board turnover can result in what I call "working on the engines of the airplane while it is in the air." It did happen here at BLMH and it is why I say I've been cleaning up messes created by others each and every year I've been on the board. It has taken me about 3000 manhours to get to where we are today. This is something to be avoided. That's common sense.

Reserve studies are helpful, but boards have latitude about when to begin projects and how rapidly to complete them. Some boards may not use the studies for the tools they are meant to be. That is a problem.

BLMH was built in about three years. New construction can proceed at a very rapid pace as compared to repairing occupied buildings. Boards cannot simply reconstruct a large HOA while hundreds of residents are living in it. Consider the inconvenience and disruption to residents projects may cause. Some of this may not be avoided, but it does need to be considered when planning these projects. Some common sense might be necessary. For example, it might not be practical to replace 10 large roofs in a year. We had great difficulty doing eight in one year. The other extreme, replacing 2 per year is certainly easy, but that approach would require 22 years for a project, and the existing roofs had a life of 15 years.

Of course, all of this is explained to each new board member in the "Board Member Handbook" they are given upon assuming their duties. Handbook? What handbook? Some HOAs have great difficulty getting a newsletter put together. Handbooks are apparently for professional organizations.

Nevertheless, boards will have to cope with large capital projects and each year the HOA board must figure out how to do this. One of the first tasks facing a board with such a large project as roof replacement on 44 buildings is to determine the remaining life of the roofs, determine a practical annual limit to the number of roofs that can be replaced and then develop a budget. That budget might require some funds for existing roof repairs if scheduling allows some roofs to reach an age 5 or more years beyond their design life. The next task is to determine how much to save for the project, when to begin accumulating funds and for how long. After doing this, the owners should be appraised of the situation and of course, fees have to be collected.

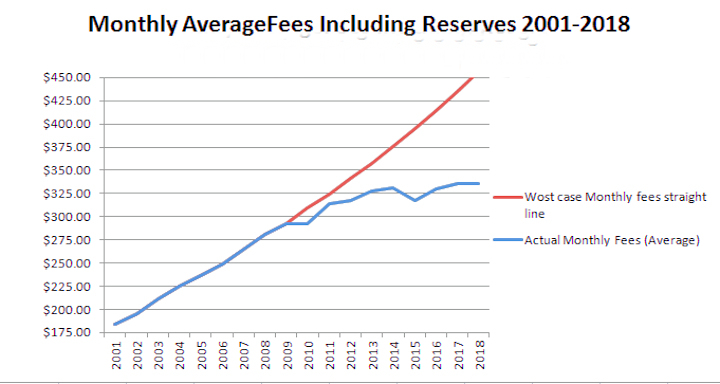

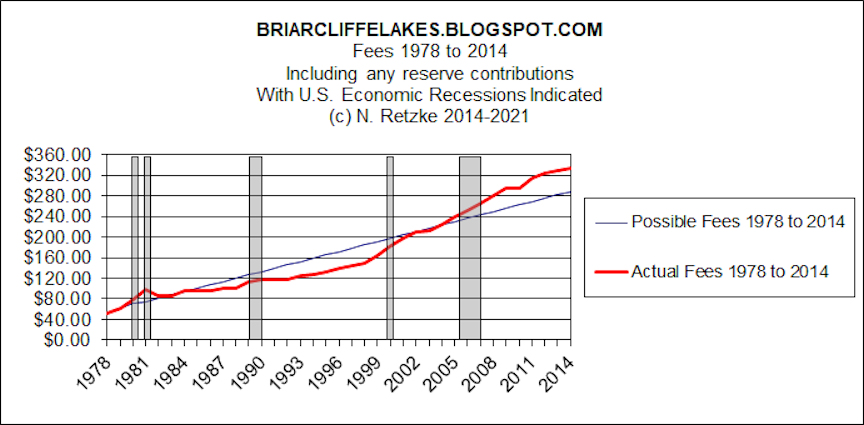

But one can't wait until the beginning of such a project to begin collecting fees. Or I should say, one should begin collecting and accumulating fees for such a project some years before it commences. But how many years? Alternately, a special assessment could be used to "jump start" such a project if the reserves are inadequate. If such projects aren't planned then the 'worst case' scenario might require a special assessment to begin the project and a large fee increase to fund it as it proceeds. Alternately, the project can be delayed while fees ramp up and funds are accumulated.

Let's assume that a pro-active board recognizes the problem and decides to begin saving for this roofing project 6 years before it begins. In such an example, the full project duration would be 6 + 16 years = 22 years. That's six years of saving and then a actual roofing for 16 years. This is not the best solution because 22 years is beyond the lifespan of simple asphalt roofs. In other words, if a roof has a 15 year life, then it might be possible to delay replacement of some roofs to 18 years if they are in good condition. But some roofs might be delayed for 22 years. In such a situation will they make it? In such a situation we are beyond reasonable limits and so I'd guess one would have to use a crystal ball.

I suggest it is best to plan using real world lifespan numbers. Neither the 'best case' or the 'worst case'. Here at BLMH we were once informed our old roofs should be expected to have a lifespan of 15 years. Today, we have some old roofs that are 22 or 23 years of age. Now, that is really pushing the envelope IMHO.

So how should a board proceed with such a project? If a board decides to begin replacing some roofs based on condition, and if those roofs are 15 years old, then it is implied that savings must begin 6 years earlier to accumulate and have on hand sufficient funds to replace all roofs in a reasonable time. So, if fees are collected for six years and then four roofs are replaced each year thereafter, the roofing project will be completed in the 16th year. Actual roofing will require 11 years from first roof to last.

However, if all of these roofs were originally constructed in a span of four years, we have another complexity. If a board decided to delay roofing replacement until absolutely necessary, then it is probable that some roofs might be replaced at the age of 13 years. These are the early failures. But what about the rest of the roofs? At that time the youngest will be 9 years of age. These roofs will reach 15 years of age in 6 years. If we assume some roofs might fail early, at 13 years, it is also likely some will do well for 18 years. In other words, the project will most likely begin when some roofs reach 13 years and will be completed when some reach 18 or even 19 years of age.

The above roofing project will require about 9 years from replacement of the first roof to replacement of the final roof. Is that a reasonable, practical possibility? Boards do have to figure this out. In my example, replacing 44 roofs would require replacing about 5 each year. In fact, at BLMH our "real" roofing project replaced one, two, three, four and eight roofs each year. It has taken more than 9 years to complete and some roofs are approaching 23 years of age.

Of course if the new roofs have a life span of 15 years then it is possible the first roof completed will reach 15 years four years after the completion of the final roof. In other words, saving for such roofs would be a continuous process. As soon as one roofing project was completed, the next would begin in about six years.

So what would a 16 year cycle of saving look like? After 5 years of saving the HOA in our example would have $625,000 in the "roofing reserves' fund. It would continue to put an additional $125,000 into this fund each and every year. However, in the 6th year the draw down on the fund would begin as roofs are replaced. In the 16th year the final roofs would be completed and the final $125,000 spent for a project total of $2,000,000.

However, the HOA in my example would immediately have to begin replenishing the roofing fund in year 17. So another $125,000 would be collected and saved in that year and for every year thereafter.

This is but an example, and there are some other things to consider in the real world:

- Projected lifespan numbers are per experts. I have my own opinions but I do not encourage homeowners or HOAs to roll the dice with roofs and I am more than a little uncomfortable with the current age of some of the roofs at BLMH. Our real word experience as well as mine in a home supports the expert opinion that simple asphalt roofs over tar paper can indeed provide good service for 15-18 years. It is also possible for some roofs to survive longer and some may fail at 13 years. My home which was built nearby had a roofing experience similar to the buildings at BLMH. A second layer of asphalt shingles were applied at the end of life of the first. The combined lifespan of the two layers was 32 years, or about 16 years each. I didn't wait until the roof was failing to replace the shingles with an entirely new roof. In other words, it might have been possible to gain another year or two on my home. Of course, that is flirting with leaks and interior damage. Not a good idea for homeowners or HOA boards, IMHO.

- Inflation must be accounted for when doing the numbers. It is reasonable to assume that the cost of roofs 17 years hence will be greater than the cost today. So future boards would find it necessary to save more than the $125,000 in the example.

- The new roofs at BLMH are architectural roofs and are a significant improvement over the old. The new include extensive ice and water shield, kynar edging, etc. The new roofs are projected to have a lifespan of 30 years with pro-rated "lifetime" manufacturer's warranties. I've studied the warranties and they provide benefit but are no guarantee of 30 year service.

- Future roofing projects may not have the same scope as current projects. For example, at BLMH the boards of 2001 and thereafter made a decision to reconfigure gutters and downspouts to move water off of driveways and adjacent to entrances. This decision required significant drainage improvements to most roofs. Boards after 2007 found that they had been committed by the earlier board to a much larger project than simply replacing roofs. Each and every owner is to be treated equally and fairly in a HOA. Future roofing projects should not require funds for these as this work is being done during the current project. However, some drainage system repairs may be necessary.

- The roof project at BLMH began as a shining example of how not to do a project. Create an expensive project at a time there are no funds for it. Begin the project while attempting to increase fees for it while doing one or two roofs per year. Create a project that commits future boards to a decade or more of fee increases in a "pay as you go" scheme. Create and begin the project with no viable financial plan. Don't communicate the scope and cost to the owners. Don't communicate the full range of problems to replacement boards. Suck the reserve coffers dry and curtail other projects including stream repairs, concrete patios, common area patios, streets and so on. Gamble on 15 year roofs surviving and providing service for 20 to 25 years. Leave it all for someone else to figure out. Leave it to others do do the heavy lifting. What a mess!