I've posted several times about budgeting in our HOA. This post focuses on solutions to some of the problems our boards have faced when trying to construct a budget. Budgeting has consequences, both short- and long-term. A variety of boards have struggled for decades with our HOA budgets.

So what can be learned from these struggles? What has worked and what hasn't?

- Setting priorities.

- Acknowledging reality.

- Don't let things get out of control.

- Balancing reserves and operations & maintenance budgets.

- Communicating with owners.

- Avoiding pitfalls.

- Avoiding panic.

- Acknowledging what worked and what did't.

There has also been a lot of focus on minutiae in the past. That can occupy all board time, but may not be effective. Minutiae can lead to a failure to prioritize, can divert resources and can obfuscate the really important things. Running in place doesn't accomplish anything.

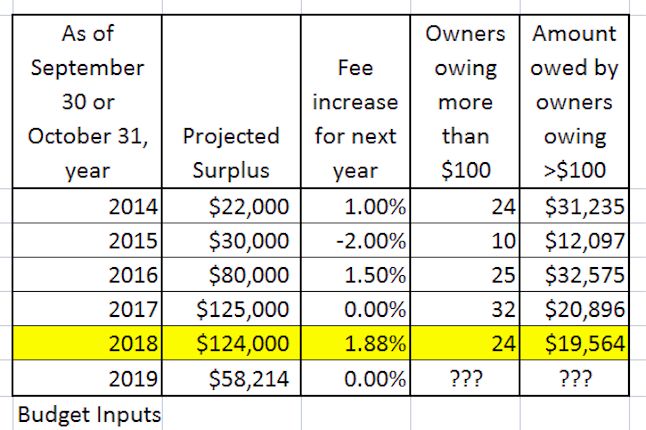

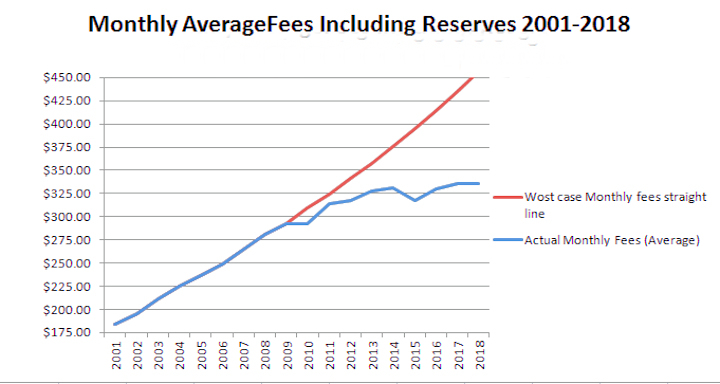

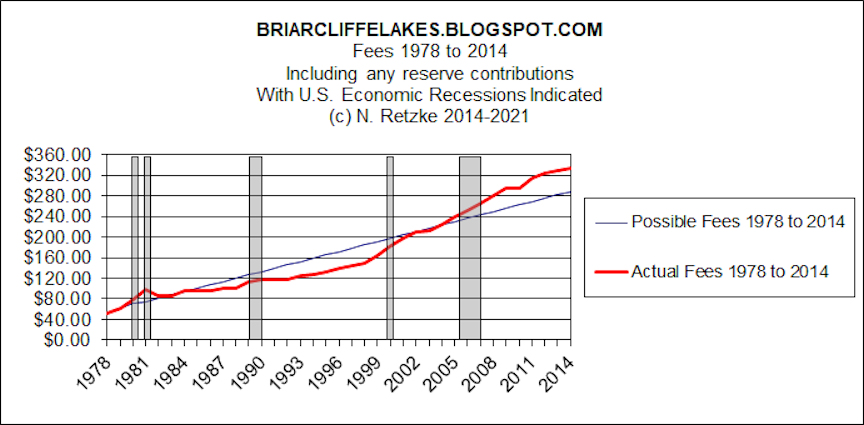

Here is an example of a failure to set priorities. In 1999 this HOA saved $20,000 in the annual budget toward the "replacement fund" which was the description for this HOA's reserves. The common elements of this HOA are valued for insurance purposes at about $90 million. In other words, in 1999 the board put aside about 0.02% of the value of this HOA for capital improvements and maintenance. This was an inadequate amount for such a large HOA that was more than 20 years old. If this were a $100,000 home, it is like saying the owner decided to put aside $22 annually for long term upkeep. Woefully inadequate. Last year the board budgeted $433,789 toward reserves, or about 25 times as much. This was not a one year phenomenon and boards have put more than $300,000 toward reserves each and every year since 2008. The average including 2008 has been $391,046 per year.

How did this happen? Several things:

- Separate the budget into two components; Operations & Maintenance and Reserve contributions.

- Create equal focus for short term issues (next year's budget) and long term capital maintenance.

- Shift from annual budgets which focused on "reasonable" annual fee increases. These budgets collected enough for the next year to the detriment of long term maintenance.

- Revitalize maintenance efforts with an emphasis on avoiding procrastination.

- Make the commitment to get frequent reserve studies by unbiased outside consultants.

- Study those reserve studies, discuss them with management and trusted contractors and compare the data to the various site surveys conducted by the board.

- Keep accurate records of infrastructure repairs.

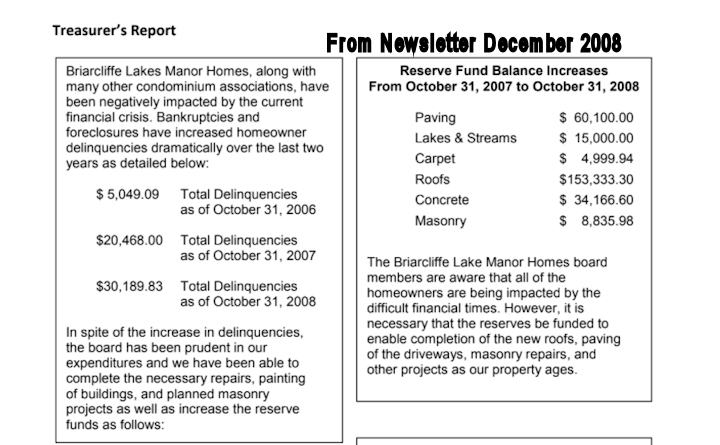

Reality can be difficult to acknowledge. Boards will do their best but some times thing don't work as planned. We can't know the condition of hidden infrastructure, nor can we predict with absolute certainty how much water we'll use next year, or how much snow will fall. Nor can we predict the extent of foreclosures or delinquencies. It is prudent to be humble and acknowledge our shortcomings. In doing so, we can build financial structures which allow us to deal with most issues.

- Closely monitor delinquencies, and build charts to trend these. Review this monthly. I create a monthly chart which provides 50 months of historical data for the board.

- Put in place and use systems to enforce fee collections. There are no exceptions.

- Know the laws of your state and use them to enforce collections. Each owner is an equal; in other words, living is an HOA is a benefit, not a right and there are costs for this.

- Monitor the state of the infrastructure. Do annual "condition surveys" for everything from walks to driveways to roofs to garage floors.

- Keep good records of the infrastructure, including dates and locations of repairs or replacements of driveways, garage floors, roofs, decks, patios and so on.

- Don't allow maintenance to fall behind. It is almost impossible to catch up. Remember that boards are volunteers. Some volunteers may not understand that a HOA is a business and that board members are supposed to work.

To avoid allowing things to get out of control is simple:

- Keep your eye on the ball. Don't look the other way.

- Don't allow maintenance to fall behind.

- Don't allow reserves to fall behind.

- Don't run the HOA as a social club.

- Treat all owners fairly and equally. No special favors!

- Don't operate the board as a popularity contest.

- Put in place communications systems for owners. Explain everything to everyone.

- Perform diligence in monitoring delinquencies.

- Don't pay undue attention to naysayers. This isn't a popularity contest and former board members may tell you "That won't work." Don't simply acquiesce to their negativity; determine why "it won't work" and then come up with creative solutions.

Balance reserve and operations & maintenance budgets:

- Don't make overly tight or restrictive O&M budgets. Remember that we can't predict the future with absolute certainty.

- Do your due diligence when constructing O&M budgets. Review contracts, determine scheduled utility increases and so on. Look at what worked last year and why. If it didn't then determine "why not" and make a financial adjustment for the next year.

- Review reserve studies. Remember these may be "worst case scenarios" and are a guide for boards and a tool. Boards ultimately determine the schedules and scope of capital projects.

- Don't spend money you don't have. In other words, don't "mortgage the future" of owners and boards and don't promote grandiose projects or schemes.

- Avoid "kicking the can down the road" and setting financial traps for future boards. If there are long term budget issues, it is best to communicate them to the owners. It is also best to determine how to solve these issues. Remember, losses can accrue and can become unmanageable very quickly.

- Avoid short shrift for reserves. All owners, both present and future are to be treated equally. That means that current owners as well as future owners need to contribute equally to long term projects.

- Design budgets which provide some financial latitude. It is easy to move annual O&M surpluses into reserves. If there is an O&M budget shortfall, it can only be solved by borrowing from reserves or special assessment.

- If there are O&M surpluses, don't forget to count them as reserve contributions and then adjust the budget accordingly.

- If capital project maintenance is delayed, then that unspent money in the reserve account isn't a surplus. It is simply unspent, and delaying creates maintenance backlogs. Acknowledge any backlog and inform owners and the board.

- If O&M maintenance is delayed, communicate to the next year's board the issues so that budgets can be constructed which identify these delays. To do otherwise is to set maintenance "land mines" for future boards. Would some board members torpedo future boards? Or throw them "under the bus?" Yes, they might.

Communicating with owners is paramount. Some owners will complain, but most assume all is well unless told otherwise.

- Communicate where possible in writing. Newsletters are a great way to inform owners of plans and issues.

- Avoid painting rosy pictures. Many boards are inclined to sweep problems under the rug and avoid informing owners. That is a huge mistake.

- Don't under inform owners and don't torpedo future boards. Yes, some boards or board members are insecure and will do this!

- Avoid pretending owners don't care. In fact, for most owners their HOA purchase is one of the largest financial decisions they will make.

- It is arrogant to assume owners aren't concerned simply because they aren't involved. Yes, we do need to communicate and re-communicate. In our HOA nearly 33% of our owners purchased their units since 2009. Yet, we've had members of the board state "I already explained that," or "No one reads the newsletter." This has been an excuse for not putting things in the newsletter in recent years. Yet, the same board member(s) will say "We need to publish the Winter Tips this month." These are the same winter tips we have published with few changes for decades. Obviously, there is a personal agenda in these matters.

Avoid pitfalls, or clean them up as soon as they occur:

- Communicate regularly with owners.

- Do background work for reserves each year and regularly update reserve studies.

- Adjust future reserve requirements to reflect any inability to do capital projects during the stated timeline. For example, our HOA doesn't always do or complete certain projects in lock step with the reserve studies. That results in reserve balances which might become larger than expected. It also creates future financial requirements for this work. A failure to recognize how those balances grew as they have, or to recognize those future requirements can lead to future financial surprises.

- Don't plan projects which don't exist in the reserve study.

- Don't spend money you don't have.

- Use the reserve study as the tool it is intended to be. Review funding plans, annual fees collected for reserves and the status of all reserve projects. Adjust the spreadsheets annually.

- Update infrastructure surveys each year.

- Don't allow maintenance backlogs to occur.

- Forcefully manage delinquencies.

- Use engineers and architects where prudent.

- Don't overestimate the skill of contractors or management. They aren't engineers or accountants.

- Hire project managers for really large and critical infrastructure projects.

- Don't become over involved with minutiae.

- Don't micromanage contractors.

- Don't send management on wild goose chases.

- Don't occupy a board position too long and do train your replacement.

- Do long term research each and every year.

- Boards should be able to communicate using email and create spreadsheets, etc.

Avoid panic. Things can and do go wrong. Sometimes, we can do everything properly but things will go wrong. That is normal. However, sometimes we fail to plan and then there will be surprises. It is nearly impossible to get a budget for a large or aging HOA to the penny. Yet, some board members will try to do this and then if reality doesn't match their delusion, they will panic or will say "You made a mistake." What a diversion! Here's a more empowering view of budgets:

- Budgets are tools for determining annual fees. Nothing more and nothing less.

- Budgets will always be imperfect. Boards can't predict annual snowfall or delinquencies.

- Accept imperfection and build fault tolerant budgets.If you don't know how, then learn.

- Learn to use spreadsheets if you don't know how. Most community colleges have adult education classes at reasonable costs for everything from spreadsheets to word processors.

- Establish priorities. If some costs increase, a well constructed budget can fund the increase with little difficulty.

- If a board takes a long term view, then it becomes possible to see budgeting as a long term event. Fees can be adjusted and reserve contributions allocated to smooth the annual fees and accomplish all financial and maintenance goals. That is the real challenge of budgeting and many boards may not be up to it.

- Avoid punishing all owners if there are foreclosures or delinquencies. Yes, it may be difficult for boards to deal with these, but there are methods by which the financial pain can be reduced or avoided. If a board finds this difficult, well, that's all a part of the job.

- Avoid emotional entanglements. This is about running a business. It is possible to deal with foreclosures, delinquencies, unforeseen maintenance problems and so on, and yet arrive at annual fee increases of less than 2%. And, it is also possible to meet maintenance objectives within those fee constraints. I know, because we do this.

- There is no substitute for planning and preparation.

- There is no substitute for a long term view. Construct budgets in tiers with 5-year, 10-year and 20-year plans. Most reserve studies have a 30 year horizon. The further out we go, the more imprecise the budgets become.

- I suggest focusing on the 5-year plan and allowing for the creation of the longer term plans while recognizing how imprecise a 30-year plan really is.

Acknowledge what works and what doesn't:

- First and foremost, be honest. Don't pretend that what you are doing is working. Get the data to determine what works and what doesn't.

- Second, put your personal agenda aside.

- Third, do the numbers. If you don't do a good budget, or determine what things cost, then you must simply accept whatever shows up. When it does, don't be surprised.

- Fourth, do the work. Do those infrastructure condition surveys. Do develop annual maintenance plans. Do communicate effectively with owners.

- Fifth, don't undermine others. We may each think we are God's gift to the universe, but we aren't.

- Sixth, know when you have done what you can and then move one.

- Seventh. Nature abhors a vacuum. In other words. no one will miss me and I will be replaced shortly after I am gone. Someone will get the job done. No kidding!