Well, the Mayan calendar has officially ended.

Perhaps we should be selling "I survived the Mayan calendar" tee shirts?

Were the Mayan's Wrong?

No, the Mayan's were not wrong. Their calendar ended exactly at the date and time it was supposed to. Similarly, our Gregorian calendar for 2012 will end precisely at midnight on December 31, 2012.

So what went wrong? Nothing. The problem was the human beings who made a faulty interpretation. They said that at the end of the Mayan Calendar that the world would end. What actually occurred was the current cycle ended.

Cycles have specific beginning and endings. So the cycle ended. Other cycles in our lives include the phases of the moon, the seasons and so on. The end of a cycle is not the end of the world. It is an event that marks the beginning of the next cycle.

Will the world end? Of course the world will end. We simply do not know precisely when.

Will the future be better or worse? Yes, it will be both. There will be better times and there will be difficult times.

My Point? We don't have a new Mayan Calendar because no Mayan has created one. Saying the world ends when a piece of paper ends a date trails is about the same as saying the world will end when I burn my checkbook.

My Suggestion?

Deal with the things we can and should deal with. Watch less TV and spend less time on the internet. Take care of our personal business, develop ourselves and get critical thinking skills. Don't expect someone else to make things happen. Plan for our death and celebrate our life.

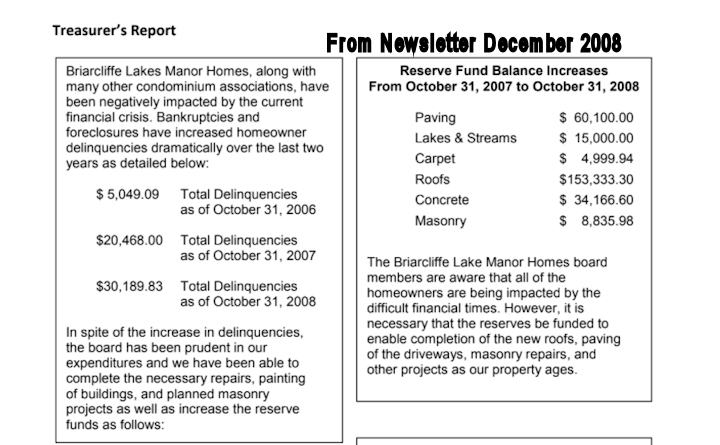

Above: Intermittently, for a time, boards informed owners of association finances

Newsletter 2008 excerpt is an example of earlier board willingness to communicate with owners.

The boards of 2019-2021 prefer not to do so.

https://tinyurl.com/BLMH2021

Life and observations in a HOA in the Briarcliffe Subdivision of Wheaton Illinois

Best if viewed on a PC

"Briarcliffe Lakes Manor Homes" and "Briarcliffe Lakes Homeowners Association"

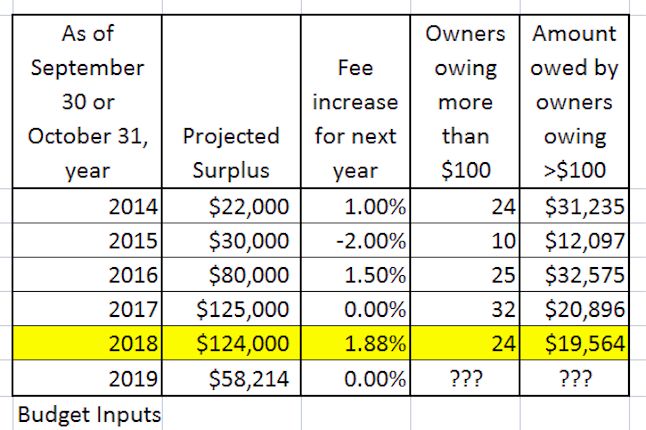

Updated Surplus Numbers

Updated Surplus Numbers: Actual surplus 2018 per audit was $85,163.

Boards 2011-2018 implemented policies and procedures with specific goals:

stabilize owner fees, achieve maintenance objectives and achieve annual budget surpluses.

Any surplus was retained by the association.

The board elected in fall 2018 decided to increase owner fees, even in view of a large potential surplus

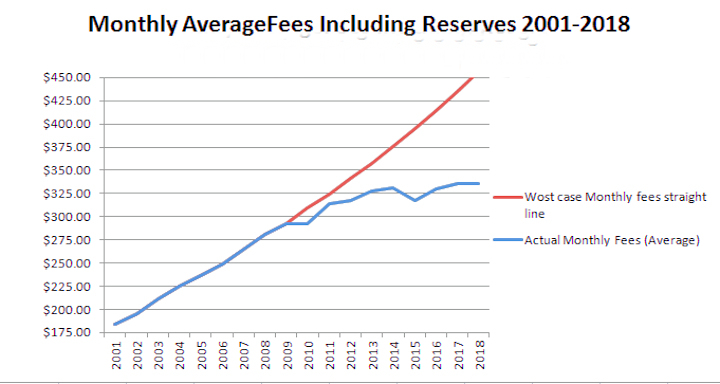

Average fees prior to 2019

Average fees per owner prior to 2019:

RED indicates the consequences had boards continued the fee policies prior to 2010,

BLUE indicates actual fees. These moderated when better policies and financial controls were put in place by boards

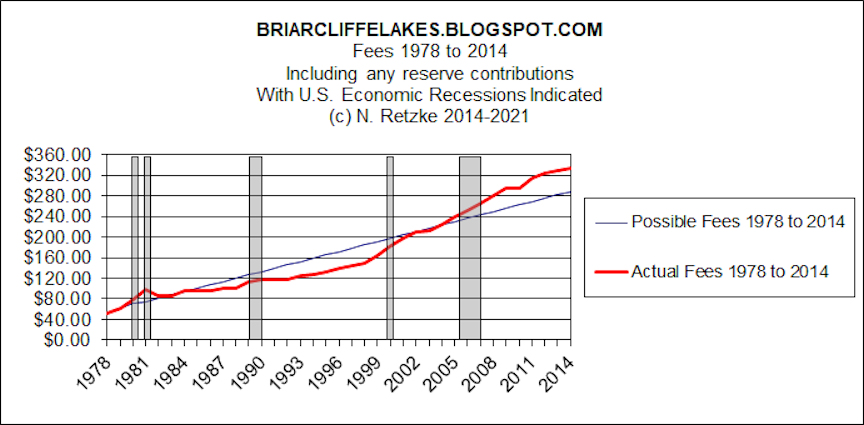

Better budgeting could have resulted in lower fees

Better budgeting could have resulted in lower fees:

RED line = actual fees enacted by boards,

BLUE line = alternate, fees, ultimately lower with same association income lower had

boards used better financial controls and focused on long term fee stability

Friday, December 21, 2012

Wednesday, December 19, 2012

Realty Check

I noticed that according to Zillow my unit is worth only about 1% more than I paid for it 10 years ago. So I guess I lost money? After all if one can't make about 3% per year then one is losing money. That's the traditional wisdom, isn't it?

Well, I did the numbers, and I actually saved $38,315.99 in the last 10 years by purchasing instead of renting. Oh, and I did get to remodel the way I wanted, and I didn't have to deal with a landlord.

What's more, I put $10,000 into a new kitchen upgrade, and I have installed hardwood floors throughout the living spaces, including entry, dining, living, kitchen and hallway.

My numbers included the cost of the kitchen upgrade, electricity, natural gas, sewer, water, property tax and condominium fees. It also took into account the interest I might have made at 4% per year if I had invested any difference between renting and purchasing. Of course, 4% is fiction. We'd all love to have a savings account which yields 4%.

So all I can say is, from my experience at BLMH, owning is better than renting.

But, there are a range of opinions in the popular media. Some suggest that owning one's home is not good, while others say it's the best thing since sliced bread. Or we can simply rent at the lowest possible cost and "invest" what's left following "Mad Money Cramer's" suggestions. He is the guy, as I recall, who went on the Today Show and told people to "sell everything." This advice was given after the Panic of 2008 and after the stock market had already plummeted. In other words, those who followed this self proclaimed guru's advice lost their retirement funds. My advice? Live within your means, save for your retirement, invest prudently and ignore the politicians, the talking heads and all of those wonderful commercials advocating why you just gotta have all of that stuff. While you're at it, ignore those credit card ads about "the wonders of just swiping."

Notes:

Well, I did the numbers, and I actually saved $38,315.99 in the last 10 years by purchasing instead of renting. Oh, and I did get to remodel the way I wanted, and I didn't have to deal with a landlord.

What's more, I put $10,000 into a new kitchen upgrade, and I have installed hardwood floors throughout the living spaces, including entry, dining, living, kitchen and hallway.

My numbers included the cost of the kitchen upgrade, electricity, natural gas, sewer, water, property tax and condominium fees. It also took into account the interest I might have made at 4% per year if I had invested any difference between renting and purchasing. Of course, 4% is fiction. We'd all love to have a savings account which yields 4%.

So all I can say is, from my experience at BLMH, owning is better than renting.

But, there are a range of opinions in the popular media. Some suggest that owning one's home is not good, while others say it's the best thing since sliced bread. Or we can simply rent at the lowest possible cost and "invest" what's left following "Mad Money Cramer's" suggestions. He is the guy, as I recall, who went on the Today Show and told people to "sell everything." This advice was given after the Panic of 2008 and after the stock market had already plummeted. In other words, those who followed this self proclaimed guru's advice lost their retirement funds. My advice? Live within your means, save for your retirement, invest prudently and ignore the politicians, the talking heads and all of those wonderful commercials advocating why you just gotta have all of that stuff. While you're at it, ignore those credit card ads about "the wonders of just swiping."

Notes:

- I've been asked if this post is realistic. That's a reasonable question to ask. It reflects my personal financial experience over a period of about 10 years. Certainly, my experience may not reflect any one else's. It depends upon the specific numbers, and more on that in the next note. The "buy versus rent" question is one that just about everyone who has purchased a home, condo or townhouse has considered. Some say it's the "universal question" of personal finance.

- In my case, i used nearby rental prices for comparisons. When we looked into buying, we did look at a range of rentals in the area for the purpose of arriving at a rental cost for comparison purposes. Here at BLMH some of the units are available for rent, and there are listings on Zillow and elsewhere. It's not too difficult to find out what a realistic monthly rental would cost. However, as we all know, there is a range of differences in these units and nearby rentals. I could have used the minimum but that wouldn't be realistic. For example, in 2000 it was possible to rent a single bedroom apartment nearby for $700 a month. Not a fair comparison to a three bedroom, two bath condo with attached garage.

- The numbers are accurate in my case. I've kept pretty good records for major purchases, repairs and upgrades, and I do use Quicken. But my numbers aren't impeccable. However, I don't think I've mis-allocated more than 10%, and if I did, that's about $30 a month.

- I know, using Zillow prices may overstate a possible selling price. However, this post is about the amount spent to rent as compared to the amount spent to purchase. It does not consider the current selling price. Why not? I'm not interested in selling today. If I take a "loss" or "gain" at the time of a sale, it will be determined by the selling price. I don't know what that price will be in 5, 10 or more years. However, if I did rent and invest any difference instead of purchasing, I'd have to speculate about how any money invested would appreciate, wouldn't I? My crystal ball doesn't tell me that, either.

- What would or could one expect today? I'd say one has to do their homework. There are aids and my favorite site is the New York Times "buy versus rent" calculator. It has an "advanced settings button which allows a lot of customization. Clicking will open a link;New Window> Buy versus Rent NYT Calculator

- Some of the things that will determine your personal result if you do consider purchasing will include:

- The purchase price.

- The amount of the down payment.

- The mortgage interest rate.

- The cost of closing, points, etc.

- The cost of a real estate attorney.

- The cost of an independent inspector.

- The length of the mortgage.

- The cost of mortgage insurance.

- The condition of the home or condo. That includes furnace, appliances, carpeting, plumbing, sinks and water valves and drains, etc. as this will determine how much is spent on repairs or replacement of these items in the near future. Eventually, everything breaks and an owner must be prepared to replace these items.

- If a home. The exterior condition and the condition of the grounds, fencing, driveway, walks, etc.

- The price for any improvements made after purchase.

- The cost to rent comparable living space.

- The cost of utilities (natural gas, electric, water and sewer).

- Other utilities which are to be considered for budgeting include telephone or cellphone, internet access and cable or satellite TV. However, when comparing renting to buying, these are usually the same in either case. So they do influence one's budget, but they probably will cost the same if one rents or purchases. But not always! Some condos include internet and cable TV with their monthly fees. It's something worth checking. Caution: At any time in the future, a condo association or HOA may shift from including such amenities as part of the monthly fees to having owners purchase these directly.

- The cost of fees if a condominium or HOA.

- The cost of any special assessments if a condominium or HOA.

- The cost of real estate taxes.

- The cost of homeowners or condominium insurance.

- If a home or townhome, the cost of any "tools" necessary for maintenance. This include hose and sprinkler, lawnmower, snowplow, snow shovel, fertilizer spreader, brooms, rakes, and annual supplies (grass seed, fertilizer) and other misc. Or you can pay someone else to do these normal chores, but that needs to be considered if one is comparing purchase to rental.

- If a home or townhome, the cost of exterior maintenance. Doors, trim, wood siding must be painted or stained about every 5 years or so.

- The cost of interior decorating. That includes paint, carpeting, etc.

- The thoroughness with which you pursue this and your personal financial situation. If you use Quicken, have a good budget, can plan and prepare financially, have low credit card and student loan debt and live within your means, then you probably are on the right track and do understand your personal finances. If you don't do these things then purchasing might be more financial responsibility than you can deal with.

Tuesday, December 4, 2012

Realty, er, Reality Check

It's been a couple of years since my last posting on real estate and prices. I haven't really seen the need because there have been so many experts and opinions. However, I'll put forth my two cents. I called my post, on August 1, 2010 a "Reality Check." I noticed a writer at the Chicago Tribune recently used the same title for their update on the Real Estate market.

The real estate market is determined by many factors. These include availability and pricing of homes and condos, availability and terms for mortgages, interest rates, employment, the economy, and many others.

All Real Estate is Local

CoreLogic, a real estate data firm, announced that for the 12 months ending October 31, home real estate prices in the U.S. was up 6%. That's good news, but they say all real estate is local. 45 states experienced real estate price increases. But not Illinois. Why is that? Here in the State of Illinois we are losing population, the state government has a history of political malfeasance, and nearby Chicago seems to be reverting to a "Dodge City" on the lake. Oh, and let's not forget that the state is broke, and is not considered a prime location for corporate business centers. Among other things, high uncertainty about taxes is a problem.

According to CoreLogic, Chicago can claim another first. It is the riskiest city in the country for mortgage fraud, and that is the second year of distinction for the city. Mortgage fraud is, in simple terms, where the buyer lies about their financial situation, so as to get a mortgage. Nationally, about $13 billion in mortgages originated in 2012 did involve mortgage fraud. According to CoreLogic's fraud risk report "It includes risk indices across multiple fraud types including employment, identity, income, occupancy, property and undisclosed debt."

None of this is good for attracting new buyers in the area or the state. However, there are pockets of improvement, and DuPage County is one of them.

Dupage County and Zip 60189

Here's a recent interest index from the Tulia.com real estate site:

Foreclosures

CoreLogic also maintains a datebase of home in the national foreclosure inventory. These are distressed mortgages and homes that are sometime sold at "firesale" prices. They depress the prices, and add to the negative perception of real estate. The good news is the so called inventory of foreclosed homes is decreasing slowly. The bad news? It would take 31 years to properly liquidate all of these homes at the current rate. That obviously will not happen!

According to CoreLogic "Approximately 1.3 million homes, or 3.2 percent of all homes with a mortgage, were in the national foreclosure inventory as of October 2012 compared to 1.5 million, or 3.6 percent, in October 2011. Month-over-month, the national foreclosure inventory was down 1.3 percent from September 2012 to October 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process."

The Bigger Picture

The Wall Street Journal on November 15 had an article about the Federal Reserve's position. Chairman Benanke gave a speech on November 13. "The housing market, despite nascent signs of revival, is still plagued by tight credit, underwater borrowers and overdue loans, Federal Reserve Chairman Ben Bernanke said in a speech Thursday that expressed a great deal of caution about the progress of the U.S. economic recovery."

There are other problems. The Mortgage Bankers Association has stated that 4.1% of mortgage loans on one-to-four-unit homes were in the foreclosure process at the end of the day September 30th. That's about 1.9 million homes! This is about 46% more homes than are currently in the "national foreclosure inventory."

It's reasonable to assume that most of those homes will be on the market, and will be competing for buyers looking for a new home and existing homes for sale.

Foreclosures have decreased from 4.4% over the past year, and this is supposedly the lowest level since early 2008.

Meanwhile, the FHA has announced that as of September 738,991 single family loans which are insured by the Federal Housing Administration are 90 or more days past due or in foreclosure. That's an increase of 100,000 from one year ago. Obviously, things are not getting better! The problem is so severe that the FHA will probably go to Congress to get cash from the taxpayers to bail out these insured mortgages. Yes, that's right. You and I are paying taxes so that the FHA can be given money to hand over to banks in the event these FHA borrowers foreclose. Most taxpayers are probably unawares that they are on the hook for bad mortgages insured by the government. But we are.

How much money are we talking about? Oh, about 9.6% of the $1.08 trillion guaranteed mortgages, which is about 104 Billion Dollars. How much is that? It's about what the Federal Government spends each year for all transportation in the U.S. It isn't nearly as much as is spent on education. I suppose we should be grateful that the politicians haven't pulled the plug on schools to assure that everyone who wants a home, or who thinks they are entitled to be a homeowner, does in fact get a home.

The Realtor's (r) View

The Wall Street Journal also recently quoted the National Association of Realtors Chief Economist Lawrence Yun, who presented at the NAR national conference in Orlando, Florida. Mr. Yun "foresees U.S. home prices rising by 15% over the next three years.." However, the WSJ also noted that "Mr. Yun is widely known for his optimistic forecasts, given his employer, the nation’s largest housing cheerleader."

Mr. Yun is apparently concerned about a housing shortage, and is also concerned about home affordability. In other words, supply and demand issues. "Supply remains relatively scarce because builders are not producing as many homes as in past years. Mr. Yun predicts that construction will ramp up to 1.3 million units by 2014, but that still would be below the historic average of 1.5 million." Mr. Yun added that “Builders need to add more,” Mr. Yun said at the group’s annual conference. “We need to moderate the price growth.”

The problem here is all of those foreclosures. I guess that the NAR is writing these millions of homes off as unsaleable by the Realtors. What other reason is there to ignore them in the statistics?

Of course, some of those foreclosed homes do make it to market, and they are depressing the prices of existing home sales. It's almost as if there are two different housing markets out there. The "new" home market and the "used" home market. However, they may be interconnected, as both markets are vying for the money of the potential home buyer. Also, with current depressed prices, a used home can be much cheaper than a new one.

Some think there is a housing boom coming. A statistic that is used is new housing starts. Prior to the housing crisis, there were about 700,000 more homes built each year than were needed. Current statistics indicate that today the opposite has occurred and at present about 500,000 fewer homes are being built each year than are necessary. This statistic is most often used by those who talk about a coming housing shortage, or a housing boom on the horizon.

"Too Good To Be True" Mortgage Advertising

At present, mortgage rates and refinancing rates are very low. This has contributed to home sales. There are some wonderful mortgage rates being promoted, but some of it is deceiving. It seems some of these advertisements are too good to be true.

Apparently, some of the brokers or lenders have advertisements that purport that they are a part of the U.S. government. These firms, which have absolutely no affiliation to the government have added “Government Loan Department” to their company’s return address, or official appearing seals and logos.

The Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission have announced a crackdown on mortgage ads. Those to whom warning letters have been sent include lenders, home builders, advertisers and mortgage brokers. They have been instructed to clean up their advertising.

Mortgage Fraud

One picture is worth a thousand words, is the old saying. Here's a photo of a "home" that received a loan in excess of $100,000. It had no floor to speak of, and was basically a wooden structure sitting on the ground. Was fraud involved? We had a unit here that sold for less, and obviously provides much higher value than the building in this photo. What more can I say?

Rising Rents

Renting is the usual alternative to buying. Or living with a relative. Renters include those driven there by the foreclosure of their property. But rents are rising. In 2008 the national rental-vacancy rate peaked at 8%, the highest level in nearly a decade. By 2010 the national vacancy rate had dropped to 6.2%, as reported by Reis Inc., a real-estate data company. The vacancy rate is expected to continue to drop to 5.5% by December 31, 2012. This is bad news for tenants, because landlords are raising rents and lowering incentives. According to Zillow.com, Chicago rents rose 9.1% in 2011. Zillow currently shows 67 homes, condos and apartments are for rent in Wheaton.

"Moreover, rising rents increase demand as buying becomes more attractive than renting because of low purchase prices and higher rents." Zillow Chief Economist Dr. Stan Humphries at ChicagoNow.com.

Indebtedness and Buyer Finances

The level of indebtedness in the U.S. remains high. Consumers are reducing the level of revolving, or credit card debt. In fact the change has been remarkable. Here is a chart from the St. Louis Federal Reserve:

The Fed also has the following chart, and as can be seen, debt is not all that rosy. Here is the actual debt level. As can be seen, it's still near historically high levels and has doubled since 2000:

Student Debt

There is another worrisome trend. Student debt has been rising and is now about 5 times greater than it was in 2000. According to the St. Louis Federal Reserve, it topped $1 Trillion this summer, exceeding other types of consumer debt. This is significant because it would be expected that the next wave of buyers will be the young who have graduated college, entered the work force, decided to marry and have children and then want to have a place to raise that family.

Here's a chart widely circulated by the "Occupy" group to support their position of the dire straits of college graduates. The political platform was "debt forgiveness." This chart is grossly inaccurate and overstates the amount of student loan debt. It has been conjectured that the following diagram uses the ratio of the diameters instead of the ratio of the areas. I think this is an important error, because it's a simple math error, and a failure to understand simple arithmetic concepts is a good way to get into serious debt. .

Here is the proper chart, which was printed on Mother Jones. it accurately shows the change in student debt since 2000.

The Obama administration, as part of the 2008 press for education incentives, has promoted student debt. A cynic would say that this was intended to keep people off of the employment rolls, and thereby lower the unemployment numbers.

Whatever the reason, we now find student debt has exceeded revolving credit debt. So more and more graduates are entering an anemic jobs market with substantial credit card and loan debt. These people will have great difficulty achieving home ownership. A student loan of $50,000 represents a $5,000 annual payment plus interest for 10 years. In other words, about $450 a month. The average college debt is 27,000 and here in Illinois, 64% graduate with some debt. The unemployment rate for college graduates was reported as 8.8% in 2011. According to a CNN Money article dated October 18, 2012 "Of the 1,057 colleges in the study, average debt per graduate ranged from $3,000 to $55,250. At 114 colleges, graduates had average debt above $35,000, while 64 colleges said that more than 90% of seniors graduate with debt."

It is not surprising that we now hear of people carrying student loan debt all the way to retirement age. Nor is it surprising that we hear some calling for "debt forgiveness." After all, it's an easy moral step from thinking "I'll just borrow the money and deal with the consequences later" to reaching the point where "Someone else should pay; why should I be held accountable for my debts?"

What is truly unfortunate about student debt is that it is not inevitable, or there are methods to reduce the levels of borrowing. It is also true that the purpose of higher education is to prepare one for the work force, and that upon completion of education, one can expect that it will be necessary to work 40 hours a week for 40 or more years. The money earned will be used to pay off debts, pay for one's food and shelter, provide retirement savings, and if there is anything left, then one can party and buy the bling or something better than a slightly used car.

So how are the graduates or others with student loans doing as responsible citizens? At the end of September payments on 11% of student-loan balances were 90 or more days in arrears. These people will have difficulty getting a home mortgage unless they clean up their credit, or unless the Congress begins pushing another program of "homes for everyone, even those who can't afford one."

Conclusion

Real estate is improving slowly. Some think that prices will generally improve each year, but will take 5 to 10 years to get back to the good old days.

There are also those who say this country has a financial awareness disaster. I agree there is a personal financial disaster. However, I don't think it is about awareness. It's difficult for me to accept that someone who goes to a four year college and gets a degree is not able to figure this out and live a financially responsible life. Ditto for anyone with a 2 year Associates Degree. Supposedly 56% of adults in this country have some higher education.

I am of the opinion that what we face is a "responsibility" disaster, where people of all ages refuse to take responsibility for their actions. It's much easier to use age or circumstance as an excuse, and pass the buck and the problems on to someone else. Like cheating in taxes "everyone does it" is the motto.

Notes:

The real estate market is determined by many factors. These include availability and pricing of homes and condos, availability and terms for mortgages, interest rates, employment, the economy, and many others.

All Real Estate is Local

CoreLogic, a real estate data firm, announced that for the 12 months ending October 31, home real estate prices in the U.S. was up 6%. That's good news, but they say all real estate is local. 45 states experienced real estate price increases. But not Illinois. Why is that? Here in the State of Illinois we are losing population, the state government has a history of political malfeasance, and nearby Chicago seems to be reverting to a "Dodge City" on the lake. Oh, and let's not forget that the state is broke, and is not considered a prime location for corporate business centers. Among other things, high uncertainty about taxes is a problem.

According to CoreLogic, Chicago can claim another first. It is the riskiest city in the country for mortgage fraud, and that is the second year of distinction for the city. Mortgage fraud is, in simple terms, where the buyer lies about their financial situation, so as to get a mortgage. Nationally, about $13 billion in mortgages originated in 2012 did involve mortgage fraud. According to CoreLogic's fraud risk report "It includes risk indices across multiple fraud types including employment, identity, income, occupancy, property and undisclosed debt."

None of this is good for attracting new buyers in the area or the state. However, there are pockets of improvement, and DuPage County is one of them.

Dupage County and Zip 60189

Here's a recent interest index from the Tulia.com real estate site:

Foreclosures

CoreLogic also maintains a datebase of home in the national foreclosure inventory. These are distressed mortgages and homes that are sometime sold at "firesale" prices. They depress the prices, and add to the negative perception of real estate. The good news is the so called inventory of foreclosed homes is decreasing slowly. The bad news? It would take 31 years to properly liquidate all of these homes at the current rate. That obviously will not happen!

According to CoreLogic "Approximately 1.3 million homes, or 3.2 percent of all homes with a mortgage, were in the national foreclosure inventory as of October 2012 compared to 1.5 million, or 3.6 percent, in October 2011. Month-over-month, the national foreclosure inventory was down 1.3 percent from September 2012 to October 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process."

The Bigger Picture

The Wall Street Journal on November 15 had an article about the Federal Reserve's position. Chairman Benanke gave a speech on November 13. "The housing market, despite nascent signs of revival, is still plagued by tight credit, underwater borrowers and overdue loans, Federal Reserve Chairman Ben Bernanke said in a speech Thursday that expressed a great deal of caution about the progress of the U.S. economic recovery."

There are other problems. The Mortgage Bankers Association has stated that 4.1% of mortgage loans on one-to-four-unit homes were in the foreclosure process at the end of the day September 30th. That's about 1.9 million homes! This is about 46% more homes than are currently in the "national foreclosure inventory."

It's reasonable to assume that most of those homes will be on the market, and will be competing for buyers looking for a new home and existing homes for sale.

Foreclosures have decreased from 4.4% over the past year, and this is supposedly the lowest level since early 2008.

Meanwhile, the FHA has announced that as of September 738,991 single family loans which are insured by the Federal Housing Administration are 90 or more days past due or in foreclosure. That's an increase of 100,000 from one year ago. Obviously, things are not getting better! The problem is so severe that the FHA will probably go to Congress to get cash from the taxpayers to bail out these insured mortgages. Yes, that's right. You and I are paying taxes so that the FHA can be given money to hand over to banks in the event these FHA borrowers foreclose. Most taxpayers are probably unawares that they are on the hook for bad mortgages insured by the government. But we are.

How much money are we talking about? Oh, about 9.6% of the $1.08 trillion guaranteed mortgages, which is about 104 Billion Dollars. How much is that? It's about what the Federal Government spends each year for all transportation in the U.S. It isn't nearly as much as is spent on education. I suppose we should be grateful that the politicians haven't pulled the plug on schools to assure that everyone who wants a home, or who thinks they are entitled to be a homeowner, does in fact get a home.

The Realtor's (r) View

The Wall Street Journal also recently quoted the National Association of Realtors Chief Economist Lawrence Yun, who presented at the NAR national conference in Orlando, Florida. Mr. Yun "foresees U.S. home prices rising by 15% over the next three years.." However, the WSJ also noted that "Mr. Yun is widely known for his optimistic forecasts, given his employer, the nation’s largest housing cheerleader."

Mr. Yun is apparently concerned about a housing shortage, and is also concerned about home affordability. In other words, supply and demand issues. "Supply remains relatively scarce because builders are not producing as many homes as in past years. Mr. Yun predicts that construction will ramp up to 1.3 million units by 2014, but that still would be below the historic average of 1.5 million." Mr. Yun added that “Builders need to add more,” Mr. Yun said at the group’s annual conference. “We need to moderate the price growth.”

The problem here is all of those foreclosures. I guess that the NAR is writing these millions of homes off as unsaleable by the Realtors. What other reason is there to ignore them in the statistics?

Of course, some of those foreclosed homes do make it to market, and they are depressing the prices of existing home sales. It's almost as if there are two different housing markets out there. The "new" home market and the "used" home market. However, they may be interconnected, as both markets are vying for the money of the potential home buyer. Also, with current depressed prices, a used home can be much cheaper than a new one.

Some think there is a housing boom coming. A statistic that is used is new housing starts. Prior to the housing crisis, there were about 700,000 more homes built each year than were needed. Current statistics indicate that today the opposite has occurred and at present about 500,000 fewer homes are being built each year than are necessary. This statistic is most often used by those who talk about a coming housing shortage, or a housing boom on the horizon.

"Too Good To Be True" Mortgage Advertising

At present, mortgage rates and refinancing rates are very low. This has contributed to home sales. There are some wonderful mortgage rates being promoted, but some of it is deceiving. It seems some of these advertisements are too good to be true.

Apparently, some of the brokers or lenders have advertisements that purport that they are a part of the U.S. government. These firms, which have absolutely no affiliation to the government have added “Government Loan Department” to their company’s return address, or official appearing seals and logos.

The Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission have announced a crackdown on mortgage ads. Those to whom warning letters have been sent include lenders, home builders, advertisers and mortgage brokers. They have been instructed to clean up their advertising.

Mortgage Fraud

One picture is worth a thousand words, is the old saying. Here's a photo of a "home" that received a loan in excess of $100,000. It had no floor to speak of, and was basically a wooden structure sitting on the ground. Was fraud involved? We had a unit here that sold for less, and obviously provides much higher value than the building in this photo. What more can I say?

Rising Rents

Renting is the usual alternative to buying. Or living with a relative. Renters include those driven there by the foreclosure of their property. But rents are rising. In 2008 the national rental-vacancy rate peaked at 8%, the highest level in nearly a decade. By 2010 the national vacancy rate had dropped to 6.2%, as reported by Reis Inc., a real-estate data company. The vacancy rate is expected to continue to drop to 5.5% by December 31, 2012. This is bad news for tenants, because landlords are raising rents and lowering incentives. According to Zillow.com, Chicago rents rose 9.1% in 2011. Zillow currently shows 67 homes, condos and apartments are for rent in Wheaton.

"Moreover, rising rents increase demand as buying becomes more attractive than renting because of low purchase prices and higher rents." Zillow Chief Economist Dr. Stan Humphries at ChicagoNow.com.

Indebtedness and Buyer Finances

The level of indebtedness in the U.S. remains high. Consumers are reducing the level of revolving, or credit card debt. In fact the change has been remarkable. Here is a chart from the St. Louis Federal Reserve:

The Fed also has the following chart, and as can be seen, debt is not all that rosy. Here is the actual debt level. As can be seen, it's still near historically high levels and has doubled since 2000:

Student Debt

There is another worrisome trend. Student debt has been rising and is now about 5 times greater than it was in 2000. According to the St. Louis Federal Reserve, it topped $1 Trillion this summer, exceeding other types of consumer debt. This is significant because it would be expected that the next wave of buyers will be the young who have graduated college, entered the work force, decided to marry and have children and then want to have a place to raise that family.

Here's a chart widely circulated by the "Occupy" group to support their position of the dire straits of college graduates. The political platform was "debt forgiveness." This chart is grossly inaccurate and overstates the amount of student loan debt. It has been conjectured that the following diagram uses the ratio of the diameters instead of the ratio of the areas. I think this is an important error, because it's a simple math error, and a failure to understand simple arithmetic concepts is a good way to get into serious debt. .

Here is the proper chart, which was printed on Mother Jones. it accurately shows the change in student debt since 2000.

The Obama administration, as part of the 2008 press for education incentives, has promoted student debt. A cynic would say that this was intended to keep people off of the employment rolls, and thereby lower the unemployment numbers.

Whatever the reason, we now find student debt has exceeded revolving credit debt. So more and more graduates are entering an anemic jobs market with substantial credit card and loan debt. These people will have great difficulty achieving home ownership. A student loan of $50,000 represents a $5,000 annual payment plus interest for 10 years. In other words, about $450 a month. The average college debt is 27,000 and here in Illinois, 64% graduate with some debt. The unemployment rate for college graduates was reported as 8.8% in 2011. According to a CNN Money article dated October 18, 2012 "Of the 1,057 colleges in the study, average debt per graduate ranged from $3,000 to $55,250. At 114 colleges, graduates had average debt above $35,000, while 64 colleges said that more than 90% of seniors graduate with debt."

It is not surprising that we now hear of people carrying student loan debt all the way to retirement age. Nor is it surprising that we hear some calling for "debt forgiveness." After all, it's an easy moral step from thinking "I'll just borrow the money and deal with the consequences later" to reaching the point where "Someone else should pay; why should I be held accountable for my debts?"

What is truly unfortunate about student debt is that it is not inevitable, or there are methods to reduce the levels of borrowing. It is also true that the purpose of higher education is to prepare one for the work force, and that upon completion of education, one can expect that it will be necessary to work 40 hours a week for 40 or more years. The money earned will be used to pay off debts, pay for one's food and shelter, provide retirement savings, and if there is anything left, then one can party and buy the bling or something better than a slightly used car.

So how are the graduates or others with student loans doing as responsible citizens? At the end of September payments on 11% of student-loan balances were 90 or more days in arrears. These people will have difficulty getting a home mortgage unless they clean up their credit, or unless the Congress begins pushing another program of "homes for everyone, even those who can't afford one."

Conclusion

Real estate is improving slowly. Some think that prices will generally improve each year, but will take 5 to 10 years to get back to the good old days.

There are also those who say this country has a financial awareness disaster. I agree there is a personal financial disaster. However, I don't think it is about awareness. It's difficult for me to accept that someone who goes to a four year college and gets a degree is not able to figure this out and live a financially responsible life. Ditto for anyone with a 2 year Associates Degree. Supposedly 56% of adults in this country have some higher education.

I am of the opinion that what we face is a "responsibility" disaster, where people of all ages refuse to take responsibility for their actions. It's much easier to use age or circumstance as an excuse, and pass the buck and the problems on to someone else. Like cheating in taxes "everyone does it" is the motto.

Notes:

- I've expanded the section on student debt.

- I was asked about bad loans held by banks. A lot has already been written off. How much? Bank of America has charged off over $25 Billion each year for four years; a total of $105 billion for bad loans. Most of these were supposedly made to subprime borrowers. Countrywide Financial was the company that financed 20% of all mortgages in the U.S. in 2006. In 2008 BofA purchased Countrywide for $4.1 billion. Now that is what we call a spectacularly bad purchase!

Subscribe to:

Posts (Atom)