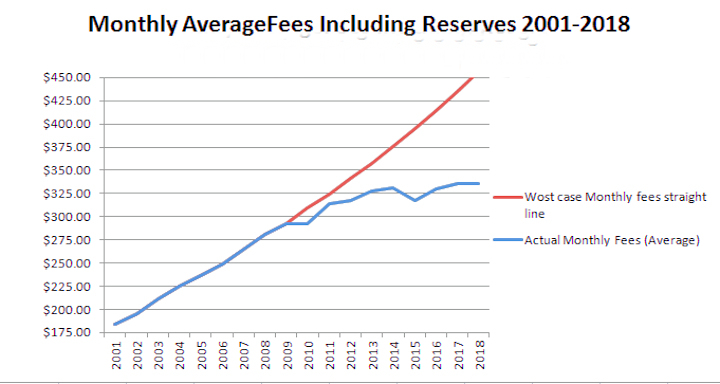

"The fees collected for reserves at BLMH have increased by nearly 8.75% each and every year for the period 2001-2015. The O&M expenses actually increased by less than 1.5% each year."

The above statement is the result of my ongoing cost/fee analysis at my HOA. This is precisely why I have put so much effort into scrutinizing the reserves here at BLMH. Because reserves are nearly one-third of our owners fees, any moderation in reserve requirements will have a very large, and disproportionate effect on annual budget requirements and on our owners fees. Conversely, if reserve requirements go upwards, that too will have a very large effect on fees, and it has, for 15 years.

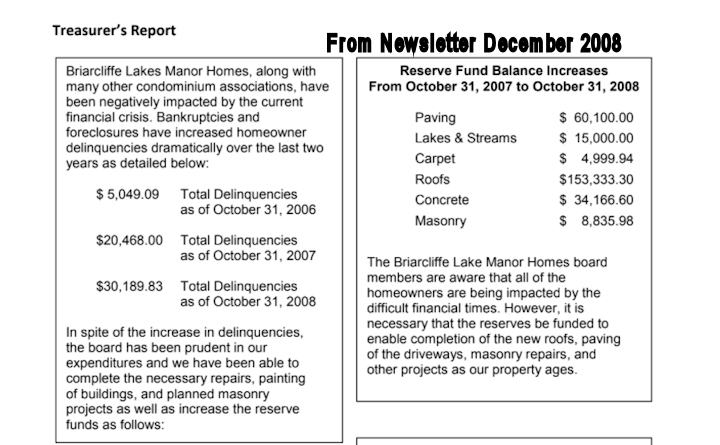

Not everyone understands this. Boards at BLMH have historically focused on the O&M expenses. In doing so they miss the elephant in the room. This is not news. It began decades ago when boards focused on meeting annual expenses and darn near ignored capital expenses and replacement costs. Some boards operated on automatic which is why there is resistance to fees determined by actual budgetary requirements. It is easier to do an O&M budget and then increase fees by 2 or 3 percent. Any income excess can be allocated to reserves, ignoring actual requirements.

It could be worse. In some HOAs the boards simply go with low annual fee increases, or none, and then pass special assessments to deal with budget issues. But in recent years our HOA has declared that we want a steady approach. I agree because I think that is best for our owner/shareholders. That sounds simple. Getting there is not and doing the work falls on a few of the board.

In other words, making these grand statements is easy. Doing the work to make it happen is not. Which is why I put in 450 to 700 hours each year as a "volunteer" on a HOA board. What a bad deal!

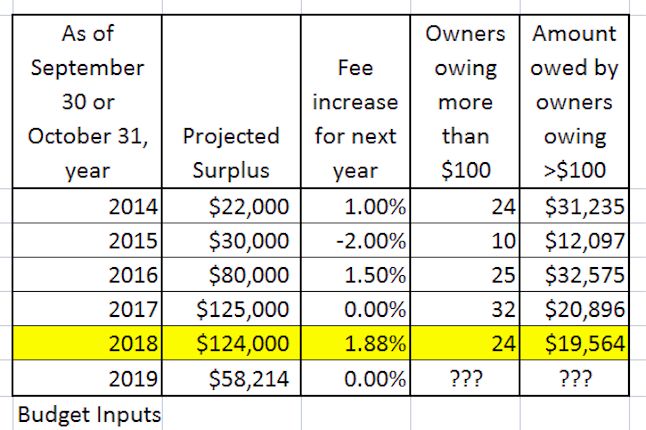

Last year this HOA had a 0% fee increase. For some board members, you would have thought that was sacrilege. However, if one realizes that reserve contributions have increased nearly

six times faster for 15 years than have O&M costs, then this is not really so difficult to comprehend.

I'll say it again.

Reserve contributions have increased six times faster than O&M contributions for 15 years. So where would you put your talent if you want to deal with HOA budgets? I decided some years ago that the reserves were the Achilles heel of BLMH. Therefore they must be monitored more closely and scrutinized.

How do you think we did water main replacements and street replacements decades ahead of what was planned? It wasn't fun, and there have been consequences. For example,

all of the drainage improvements would be done today if our streets hadn't failed. That is a fact. But that is another issue. For budgets, long term situations can have serious consequences.

Budgeting Overview

A short time ago I posted about the annual budget meeting, which is the first task a new board is faced with. At BLMH this occurs immediately after the election and assignment of officers.

As I am fond of saying "We need to hit the ground running." Not that I think that's the way it should be, but that is the way it is, each and every year. Is it any wonder a new board might struggle?

Budgeting should be straightforward. In a HOA it might not be. This and subsequent posts will provide some insights into the budgeting process and why it may be difficult. It also provides some history and emphasizes why it really is so important to get the budgets right. However, this is 2015, not 2000. A lot has changed since then. Some of our owners can't comprehend this.

In my blogs, it is important to understand that board members are also owners. So I may use the terms interchangeable. A "board member" is also an owner. When I describe owners, it is to be realized that what I am saying also applies to board members because they too are owners.

We are each either a part of the solution, or part of the problem

Budgets are a necessary part of any business. But many HOA owners don't run their personal lives like a business, and so a few don't expect their HOA to be run as a business, either. Some of these owners become board members. Owners bring their practical experience with them. Also their personal judgements, opinions and beliefs.

Nevertheless, the annual budgets are serious business, with long term consequences. Nothing more and nothing less.

The October 9 post delved into the some of the discussion items for the budgeting process. I have a link at the end of this post. That meeting was long because the budgeting is not a simple task and boards sometimes make it more difficult than necessary. We also have other things to do during the meeting. This is a full meeting and there are the usual agenda items, including the Homeowner's forum.

We're taking a closer look at some of the underlying assumptions and so the budget remains unresolved. One of the problems to be solved is determining the projections for the Operations & Maintenance portion of the budget. We have information about how the money was spent for the first 9 months of the year, but our budget ends on December 31. Management prepares a "projection" for the remaining three months and that provides the board with the anticipated expenditures as of December 31. There is obviously some guesswork involved.

It is done this way because "This is the way it has always been done." I suggested an alternative approach a couple of years ago with a long time board member and they were inflexible. As I pointed out at the time, this puts any new board member at a serious disadvantage and can create pitfalls for boards, both old and new.

So we continue to do our budgets with a certain amount of guesswork. The sole reason is so owner fees can be adjusted on January 1 of the year. I am of the opinion that is an artificial date imposed by boards and have stated so.

Budget Issues

I have not been completely satisfied with the budgets amd the methods used to arrive at budget projections. For example, are they straight line approximations? Should they be otherwise? I am of the opinion that the budgeting could be improved, and should be. In recent years it has been, but this is a slow process and it occurs incrementally. Change can be difficult. In my experience there may be resistance. Remember the expression "The best defense is a good offense?" Call into question how people do things and that's what one may get. It's called "push back."

I am of the opinion that with an entirely new board it could be easier; no methods or turfs to defend. On the other hand an entirely new board would have to get up to speed in less than 30 days. Won't happen and entrenched boards may have a lot of automaticity. As in, for example "We always did it that way."

Additional Scrutiny

This year, I've provided additional scrutiny to some aspects of the budget and I asked a few more questions. The purpose is to arrive at a better budget.

Each year boards literally agonize over some of the budget decisions. Boards need to meet O&M budget requirements plus reserves and then set fees. Sounds straightforward. However, if a board overspends the total O&M budget, then the HOA must make up those funds. If we use more maintenance hours than were allocated, then we may have to "borrow" hours from the next year. This of course, reduces the hours available in that following year. "Robbing Peter to pay Paul" is not a good method. It also places additional pressure on the new board. There is nothing worse than starting the year with a deficit.

If the opposite occurs and if we are under budget, then we collected more via fees from our owners than was absolutely necessary to run the HOA for the year. If this is a moderate amount, it is acceptable. To be 1% under the O&M budget could spare owners from larger, future fee increases. If we are within 1% for O&M then we are actually within about 0.7% for the entire budget because O&M is about 70% of the annual budget.

Trying to hit that bulls eye is difficult. In a household budget of $50,000 that would mean we are within $350 of such a budget, or within $175 of a $25,000 budget. I would guess that most of us aren't able to manage our household annual budgets this well. Yet, owners demand and expect that boards get it right.

Boards simply do the best they can. I suppose if we worked on the budget for the entire year, we might do better. But the reality in any HOA is some board members come to the meeting and may not be fully prepared. We have been discussing reserves for several months. But not everyone participates in the details of the planning.

How Much is 1%?

When budgeting it is really important to separate O&M requirements from reserve requirements. Why? For example, let's assume that our HOA is attempting to get our O&M budget to within 1% of the actual. That's an attempt to get the O&M budget to within $2.32 per owner per month. I'm using the average owner. What the board is attempting to do is project the costs of the future utilities, snow removal, printing, postage, legal, tree repairs, grounds maintenance, miscellaneous repairs and all other unknowns of 2016. It cannot be done with absolute precision, or if it is, it is part luck and part planning.

Owners expect and a few demand that boards walk these tight ropes and get it right. I understand the expectation and I think that's acceptable. However, for those who make demands of the board, I guess that's all a part of their desire for apartment living, where some one else is supposed to make things work.

A few years ago I brought a crystal ball to the annual meeting as a tongue in cheek symbol of the problems all boards face. If we get it right, our budgets balance. If we don't, then we either under collect the fees (overspend) or over collect fees (underspend). The only way I know to do this is to identify all known costs, and also identify the unknowns. Add them up and that's the budget.

I think everyone would agree that HOA boards should not collect money simply because they are concerned about the future possible shortfalls. Fear is not a good business plan. We need to do the numbers and then base our decisions upon them. Nor should HOA boards spend money simply because it is in the budget.

Avoiding Debt

HOAs have financial limitations and most don't want to go into debt. In a household, when people overspend and run out of cash, it may be handled by making purchases with a credit card, which can be paid off in a few months or years. HOAs don't have access to this type of quick credit, which is probably a good thing. It is my understanding that the average household owes $7,529 on their credit cards. If our HOA did this, we would have $2,529,744 in credit card debt.

With no credit card available, boards work hard to get this right, and they have been doing so for about 40 years at BLMH. If boards get it wrong, they either collect too much from owners or collect too little. It is a fact that it is impossible to get this absolutely right and have the budgets balance to within the penny.

It is obvious that a few of our owners have experienced this in their personal lives. That's why in HOAs there are delinquencies and foreclosures.

Avoiding the Short-Cut

Because we know we won't get it absolutely right some boards may take a simplistic approach. Add up what we think we know about the future budget, increase by 2 or 3 percent and then collect the necessary fees to match. It is my understanding that this is to avoid larger fee increases in the future and avoid a budget shortfall while dealing with inflation. This may not work as planned because:

- Budget surpluses don't remain in O&M accounts and so each year stands alone.

- Historically, the largest budget shortfalls at BLMH came from capital projects and reserves.

- Reserves can and do accumulate and that's essential to have the funds available for projects such as roofs and streets. But these funds can't be used for O&M.

- Reserves can and should be determined by long term planning, but some boards have problems doing this.

If boards do want to take the easy route, then I am of the opinion that two budgets must be closely scrutinized each year. These are the previous year and the coming year. For the previous year's budget, what we are interested is identifying:

- How well the crystal ball worked. Did we make good decisions? If not, why not?

- To identify those areas that may have experienced significant budget changes.

- To avoid runaway escalation of fees.

- To avoid nasty budget surprises.

- To learn from our mistakes.

As with all things budgeting, a board must be willing and able to do the necessary research and ask responsible questions.

Annual 3% budget increases might not sound like a lot, but over time these small amounts add up. Fees will double every 25 years.

Long Term Versus Short Term Trends

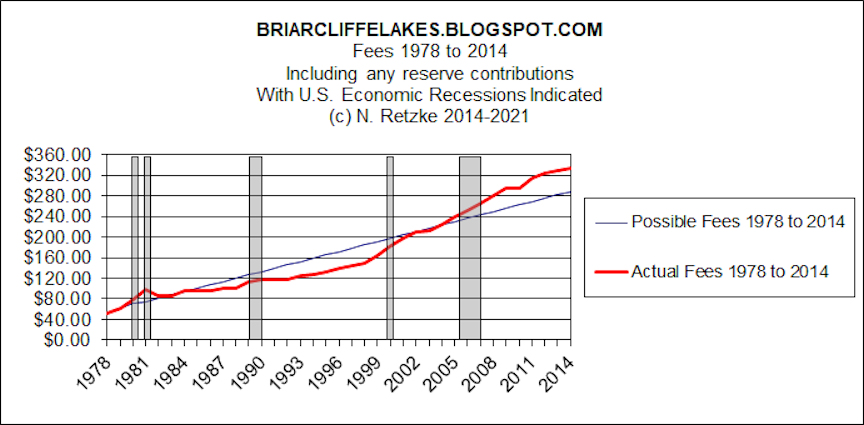

Now, over long term periods it is true that the cost of maintaining a HOA does increase. These costs may vary each year as water rates change, or we receive more or less snowfall, or roofs need repairs, or ice dams form, etc.

That's one of the pitfalls of taking, for example, the budget for expenses in 2001 and comparing it to the budget for expenses in 2015. Of course, total expenses have increased since 2001. But those increases don't occur in smooth and steady increments each year. For example, in 2001 this HOA spent $19,000 in roof repairs. In 2015 it spent $0. If we simply added 2.5% to this number each year, it would be expected that this HOA would have budgeted and spent about $27,000 in 2015 on roof repairs, but we didn't. Costs for utilities (electric and water) have increased since 2001 and by about 3% per year. However, overall the costs of O&M at BLMH have increased by less than 1.5% per year. But you wouldn't know that unless you 1) did the research and 2) separated reserves from the total amounts of fees.

But some boards do like to use generalities. It is my opinion that isn't good budgeting. Trends may be useful for identifying anomalies. This is useful for detecting changes or errors.

The Elephant in the Room

Now, there are those at BLMH who might look at historical changes to fees for guidance. But to do this properly, one must separate reserve contributions from O&M contributions. The information on fee increases is contained in the HOA welcome packet, but the percentage of fees allocated each year to reserves was not tracked in that manner. For decades, boards were concerned about total budget and the O&M accounts, but overlooked the elephant in the room.

In fact, the fees collected for reserves at BLMH have increased by nearly 8.75% each and every year for the period 2001-2015. The O&M expenses actually increased by less than 1.5% each year.

Here is the change in fees collected for reserves over the past 15 years:

2001 percent fees for reserves = 12.27%

2015 percent fees for reserves = 28.6%

2001 amount of monthly fees to reserves, average owner = $26.79

2015 amount of monthly fees to reserves, average owner = $93.27

Change in monthly amount of fees, average owner, since 2001 = $107.40

Boards are Comprised of Owners

Let's look at it this way. Boards are comprised of normal human beings. How many households in the US have viable 30 year financial plans? How many have a retirement financial plan? How many households live debt free? That's what a HOA board is expected to construct for the association. If this were so easy, most of our households would be debt free. But they aren't.

Yet, these owners as board members are the very people who create our long term budgets. I think it is fair to say that owners bring the burden of their personal finances with them when they become board members. They also bring their skills and knowledge.

Why Are My Fees What They Are?

That's one of the labels for this post. I wish that owners became more engaged in the budgeting process. By that, I wish they would observe and listen. A few will do this. Others will come to a meeting and then will complain. Some show up thinking they will figure it all out in 20 minutes. Most really don't know why their fees are what they are, and a few prefer to throw blame at someone else. Ah, the joys of apartment living where some one else is supposed to take responsibility for my well-being! But HOAs aren't apartments!

Earlier Post on Budgeting 2015:

http://briarcliffelakes.blogspot.com/2015/10/budget-meeting-2015.html