The HOA newsletter for October-November has an article which announced the decision of the October 19 association meeting. The proposed budget was mailed to all owners, and a very few attended the October and November association meetings to ask questions.

The budget passed, but it was not unanimous. In October the proposed budget, which included an approximate 2% fee decrease passed 4-3. In November, after owner opportunity to comment, the budget passed with a board vote of 4-2, with one board member absent.

Why Wasn't the Vote Unanimous?

The budget included a Operations&Maintenance increase but also a reserve funding decrease. When combined this resulted in a 2015 fee decrease for owners. An overall fee decrease was apparently a problem for some on the board.

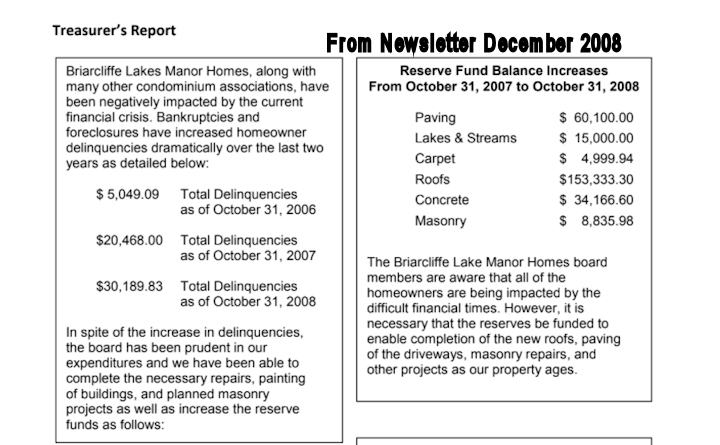

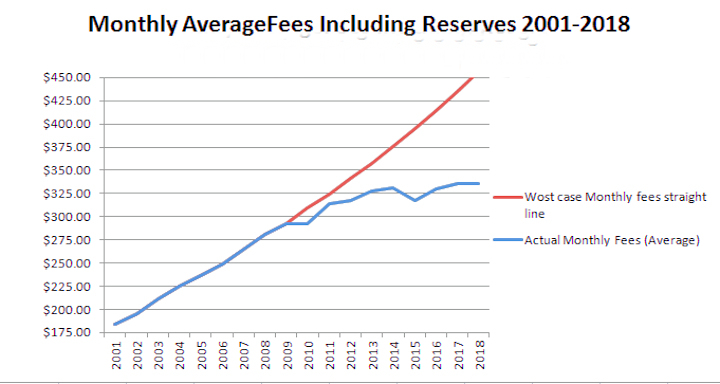

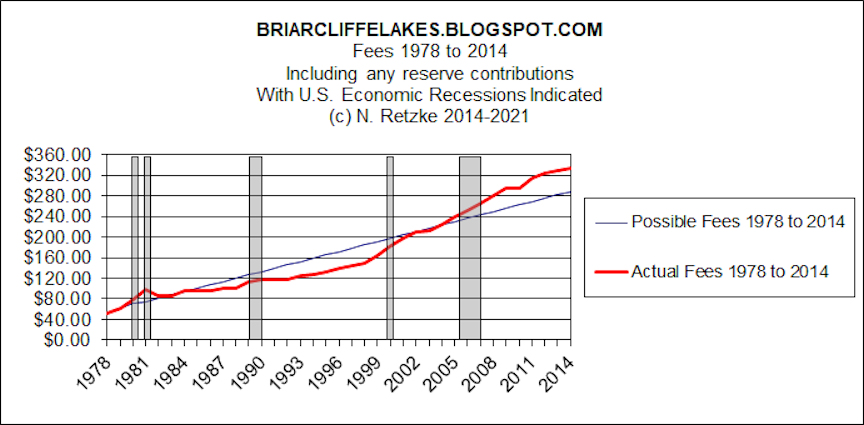

There are two parts to determining a realistic budget. The first is identifying costs. The second is determining funding for the budget, via fees. For a time this HOA did a very good job dealing with the budget for Operations and Maintenance, and managing O&M costs. Boards had greater difficulties with the reserve funding, which was at one time called the "replacement fund." As I noted in my October 6, 2014 post: "the average monthly fee for reserves.......increased with leaps and bounds at an average rate of about 10% annually from 2002 to 2014." That was to make up for previous under funding.

I think the memory of that and the pain inflicted on some board members by angry owners because of alleged "high and unreasonable fees" remains with some of the board to this very day. Boards have also been generally aware that small fee increases are easier for owners to deal with and plan for than 0% one year and 7% the next. Boards have been opposed to special assessments for decades and that remains unchanged. The combination of these concerns is probably a motivating force. But should a board member be motivated by fear and anxiety, a concern about making a mistake, a concern about looking bad, or looking good for that matter?

What's Real?

Putting fear and emotion aside, what would be the driving force for a board?

Some of the board decided an overall fee decrease was appropriate at this time and this approach passed for the 2015 budget. This was hotly debated. I used the numbers. Owners who have attended meetings for the past several years are aware of ongoing discussions about reserve funding and more recently improved cost accounting. Speaking only for myself, I scrutinize the reserve collections, reserve accumulations, project costs and completion levels.

It goes beyond this post to go into the mundane but important details of our reserve funding and capital projects. However, it's impossible to do a budget if capital expenses are ignored or grossly understated or overstated.

I've taken the time to prepare timely updates of project completion, projected reserve balances and reserve status including all anticipated projects. This has been provided ad nauseum to the boards. That includes projects anticipated but not completed and those not yet begun. Boards do, in fact, have an obligation to adjust project schedules to meet current realities. (Note 1).

What Was the Basis for My Budget Vote?

Here are the primary factors I considered in making my decision and vote:

- 2011 Reserve Study.

- Actual reserve balance and anticipated 10-15 year future balances.

- Project completion information.

- Condition of the Common and Limited Common Elements.

- Operations & Maintenance requirements for 2015 (Note 6).

- The financial impact on owners.

So how have we done? Some projects have been extended. That was prudence in part, because of an inability to do more than eight roofs in a single year. This is in part because of simple logistical issues, and board disagreement about the urgency or timetable for other projects.

In another post I'll go into greater detail about two different philosophies. One is "wait until it breaks and then fix it" while the other is "scheduled replacement." In fact, I am an advocate of a hybrid approach. More on that in the future post.

What About the Reserve Balance?

Currently, we are several hundred thousand dollars ahead of where we should be. That does include the following factors:

- Percentage completion of projects underway.

- Projected amount spent as of 12/31/2014 on projects underway.

- Amount remaining to be spent on projects underway.

- Amounts unspent but allocated to projects which were anticipated to be underway 2011-2014 but are not.

- Early project completion, which reduces future requirements.

- 2011 Reserve Study Anticipated Balance as of 12/31/2014

- Actual anticipated reserve balance as of 12/31/2014.

I've provided owners with a list of items replaced or maintained. Such work is as required by the Illinois Condominium Act. That list for the period fall 2010 to the present was included in my "candidates form" which was mailed by the association to each owner. I also included a partial list here in an earlier blog post dated October 2, 2014.

One of the significant things I've accomplished was in cataloging the condition of many common and limited common elements which had not recently been cataloged or had been ignored. Common elements and limited common elements should be inspected and condition reports updated every three years, wouldn't you agree? Of course, maintenance does do annual work and reports serious conditions. But what about condition reports for slowly aging concrete patios, garages, driveways and streams, etc.? What about rating each of these so we get some idea of their condition and future maintenance needs or schedule requirements? To do this requires man hours and shoes on the street. A failure to do this reduces the time burden on boards and conveniently allows problems to go unnoticed unless an owner complains. This fits well into a philosophy which is "if we don't spend it, we don't have to collect fees for it." Some owners seem to prefer this also, apparently believing fees are lower if only the complainers are taken care of. (Note 2).

Boards have difficulty keeping up with these things. As I stated in earlier posts, a failure to create complete and impartial condition surveys may have negative consequences. Some items may be overlooked or allowed to fall into disrepair. Owners who complain may be taken care of while others are ignored.

I deliberately published a pro-active approach in the May, 2011 association newsletter. I wanted owners and the board to understand that I was serious and impartial in my approach to maintenance in this HOA. During the past four years, with management's assistance, here's a partial list of the things I've personally surveyed and inspected since the fall of 2010. Is this important? Well, if one really wants to understand the condition of a large HOA, there is only one way. Get out and walk the entire property, tabulate condition reports, pay strict attention to reserve studies and compare all of these to see if reality meets opinion. Here's my partial list:

- Roofs, annually

- Concrete patios.

- Garage floors semi-annually.

- Driveways, annually.

- Walks, annually.

- Streets, annually.

- Streams.

- Benches and retaining walls, annually.

- Entrances.

- Drainage including soil levels around all buildings.

- Standing water on walks, etc., annually.

- Project cost accounting and reserve funding analysis, annually.

What About the Financial Impact on Owners?

It's no secret our owners face an unexpected multi-thousand dollar expense to remove or replace their fireplaces. Let's consider these realities at BLMH:

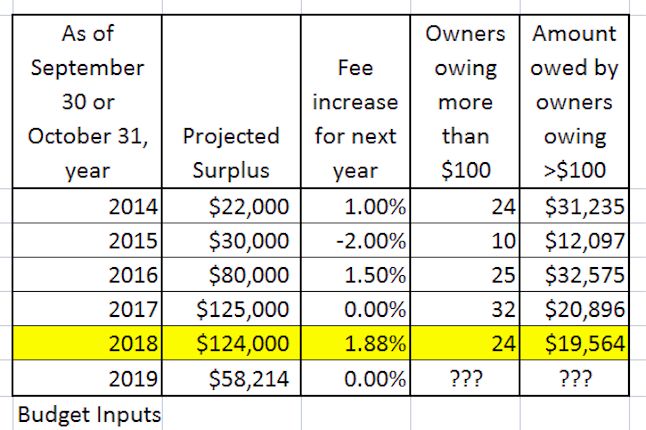

- We do have delinquencies above 10%. (Note 4).

- We have experienced bankruptcies or foreclosures every year since 2009 (to my knowledge).

- Nearly every owner faces a fireplace removal or replacement, costing perhaps $150 every month for two or more years. That's a personal, unexpected expense for about 95% of our owners.

One thing I do also consider is the financial impact of a foreclosure on all owners. This HOA recognizes noncollectable "bad debt" and that is made up via the fees of all other owners. Even a single foreclosure in the HOA of 336 does have a negative consequence on the fees of the other owners. For example, $10,000 distributed among the other owners is an additional cost of about $30 for each owner.

Knowing All of the Above, What Should a Board Member Do?

First and foremost, I consider owners to be shareholders. As a director in the corporation they own and as a fiduciary, what would be an appropriate board member decision with all the facts available to me?

I decided a fee decrease at this time was appropriate and I presented my arguments for this. Will I make the same decision next year? I cannot say because my October, 2015 vote will be based upon all of the facts presented to me and also those which I independently uncover. My vote in 2015 will also be that of a fiduciary acting on behalf of all owners, with no consideration to my personal wants, needs or desires. Should it be any other way?

What if the Board is Wrong?

I say that because what if the future shows otherwise? What about the possible fears of board members to "get it wrong?" That's a reasonable concern for a board member and I assure the reader it was so for me. Could getting it wrong possibly result in large, future fee increases? It that really a possibility?

Let's do some numbers, shall we. Let's assume the board reduces the contribution to reserves by about 12% for two years. I don't have any idea about the 2016 budget, but let's use two years to exacerbate the possible consequences.

After two years, let's assume the board decides it must make up those funds. In other words, it is determined we do need those funds for reserves. What to do? Here are two possibilities:

- Delay or extend some non-critical maintenance.

- Increase the fees toward reserves.

So what about catching up, via item 2 above? Well, the reality is, this HOA could catch up to two years of reserve adjustments if for eight years there was a fee increase of about 0.3% annually and those proceeds were allocated to reserves. Boards don't have to do this in one or two years. We're accumulating reserves for some projects which will occur 5 to 30 years into the future. Boards should consider the current state of reserves and future targets when making these decisions. A failure to do so may result in "whiplash" fee changes. Here's Chart 2 from my October 6, 2014 post to illustrate (Note 6):

In other words, there are real options available to the boards, which includes what we do know about current funding levels of reserves combined with known expenditures for the next 20 years. I am of the opinion there is little budget risk to this association in 2015. In other words, I am of the opinion that "knowing what we know" there is little current financial risk to owners in this HOA as a consequence of the 2015 budget decision.

Recently, some board members and owners looked at the cash balances and said "We have enough money." The opposite may also be true. It is conceivable that a board member, facing the reality of planning for $12 million in capital expenditures over 30 years, might conclude "We'll never have enough money" and may act out of that. Both are flawed perspectives. I suggest we do the numbers and be aware that the more distant into the future we attempt to plan, the more hazy the budgets become. No one can predict with absolute certainty what inflation will be 20 years from now, or the return on savings in 2034. Nor can we predict with absolute certainty the costs of capital replacements in 2035. What we can do is hire competent professionals and listen to them, double-check questionable items, do cost accounting, anticipate, assign possibilities and than plan for these while taking into account the impact on our shareholders.

In 2015 a reserve study update may indicate differently, or the situation may change next year or in 2017, etc. But I for one will act to deal with the consequences of such changes or a future study only after the study is thoroughly reviewed by the board and approved by the board. It is a balancing act. I point out to owners and the board that in some respects this is not the same association that existed in 2007. Yes, it is older. It also has significantly improved finances, nearly complete roofing and driveway projects, has replaced many aging common elements, has replaced one-half of the major street serving the complex, and has plans underway for walk repairs, stream repairs (some done annually in 2011-2014) and is moving forward with the replacement of the remaining streets. We have hired the surveyor so engineering plans may be made for the second half of Lakecliffe. This will allow this replacement to be done in 2015-2016 at the discretion of the board.

Yes, in many ways this is not the same association as existed in 2008. It will be interesting to see what develops another 6 years into the future. Let's hope owners provide full, competent boards and we do have those necessary shoes on the street.

Additional Information

This is for those who want to know more, and provides a reference to the above post.Board members are fiduciaries who act on behalf of all owners. All owners are to be treated equally and impartially, and the board is to budget for reserves. Finally, our association is operating under a 2011 reserve study and the Illinois Condominium Act including (765 ILCS 605/9) (from Ch. 30, par. 309) Sec. 9 (c) (2).

The Illinois Condominium Act

Here are some quotes from the Illinois Condominium Act and I have underlined several sentences. I use the ICA as one of several guides for my decisions as a fiduciary.

"...the "Reserves" means those sums paid by unit owners which are separately maintained by the board of managers for purposes specified by the board of managers or the condominium instruments."

"(765 ILCS 605/9) (from Ch. 30, par. 309) Sec. 9. Sharing of expenses - Lien for nonpayment.

(a) All common expenses incurred or accrued prior to the first conveyance of a unit shall be paid by the developer, and during this period no common expense assessment shall be payable to the association. It shall be the duty of each unit owner including the developer to pay his proportionate share of the common expenses commencing with the first conveyance. The proportionate share shall be in the same ratio as his percentage of ownership in the common elements set forth in the declaration.

(b) The condominium instruments may provide that common expenses for insurance premiums be assessed on a basis reflecting increased charges for coverage on certain units.

(c) Budget and reserves.

(1) The board of managers shall prepare and distribute to all unit owners a detailed proposed annual budget, setting forth with particularity all anticipated common expenses by category as well as all anticipated assessments and other income. The initial budget and common expense assessment based thereon shall be adopted prior to the conveyance of any unit. The budget shall also set forth each unit owner's proposed common expense assessment.

(2) All budgets adopted by a board of managers on or after July 1, 1990 shall provide for reasonable reserves for capital expenditures and deferred maintenance for repair or replacement of the common elements. To determine the amount of reserves appropriate for an association, the board of managers shall take into consideration the following:

(i) the repair and replacement cost, and the estimated useful life, of the property which the association is obligated to maintain, including but not limited to structural and mechanical components, surfaces of the buildings and common elements, and energy systems and equipment;

(ii) the current and anticipated return on investment of association funds;

(iii) any independent professional reserve study which the association may obtain;

(iv) the financial impact on unit owners, and the market value of the condominium units, of any assessment increase needed to fund reserves; and

(v) the ability of the association to obtain financing or refinancing.

(3) Notwithstanding the provisions of this subsection (c), an association without a reserve requirement in its condominium instruments may elect to waive in whole or in part the reserve requirements of this Section by a vote of 2/3 of the total votes of the association. Any association having elected under this paragraph (3) to waive the provisions of subsection (c) may by a vote of 2/3 of the total votes of the association elect to again be governed by the requirements of subsection (c).

(4) In the event that an association elects to waive all or part of the reserve requirements of this Section, that fact must be disclosed after the meeting at which the waiver occurs by the association in the financial statements of the association and, highlighted in bold print, in the response to any request of a prospective purchaser for the information prescribed under Section 22.1; and no member of the board of managers or the managing agent of the association shall be liable, and no cause of action may be brought for damages against these parties, for the lack or inadequacy of reserve funds in the association budget."

The 2011 Reserve Study

The study has recommended fee increases to build reserves and to fund current and long term projects. These are identified projects to occur in the period 2011- 2041.

The 2011 study indicated the following possible reserve balances, and by December 31, 2014 the study anticipated this HOA would have a possible reserve balance of $590,522, as show on the following chart. However, current estimates for the actual 12/31/2014 balance range from $1,500,000 to about $1,700,000. In other words, this chart seriously understates the current financial situation of this HOA with respect to reserves and reserve balances. :

How can that be? How is it possible for this HOA to have such a large reserve balance, over and above the anticipated balance indicated above?

Answering this question was an important consideration for me in addressing the 2015 budget process. I took it upon myself to determine the answer to this question. In fact, this possible "surplus" grew slowly and I did monitor it. It was not a surprise and I've taken pains to figure this out and to keep the board informed since 2011. I have bluntly stated that I have a real problem passing fees and saving for any capital improvement the board may have no intention of doing.

So how did we achieve the current reserve balance, even with an early expenditure for Lakeliffe street replacement in 2014? There are a number of possible explanations, which together include:

- Collect funds but don't spend them in accordance with the plan; in other words, alter plans or delay projects.

- Spend funds on projects which come in under budget

- Cost Accounting issues (balancing actual costs, or mis-allocating reserve projects to O&M)

- Gross errors in determining costs, etc.

Possible Concerns About Reserves and Annual Budgets

The annual budget consists of funding for Operations & Maintenance (O&M) for 2015. The budget also includes funding for reserves, and such funding recognizes capital projects for 2015 as well as those extending about 30 years into the future, in accordance with the 2011 reserve study.

Here's the problem facing each board member in a HOA. On principle, it's easier for everyone to deal with small fee increases than with larger ones. For the board it is easier to vote for a continuous series of incremental annual fee increases, than it is to go for 0% one year and risk the need to vote for 7% fee increase the next. For owners, there is also the opinion that it is easier for each of us to deal with small, continuous adjustments to fees than with fee increases that swing from 0% to 7%.

There are also concerns about long term funding of capital projects, via reserves. At present, it is relatively easy to determine reserve requirements for the next 10 to 20 years. Since 2010 there have been significant improvements to identify costs facing the association. We've identified most of the known problems. Only five years ago, there was no "contingency" fund for water main repairs and no contra fund in recognition of possible bad debts (un-collectibles). Five years ago when the board was asked about replacement funds for our extensive trees, the response was "they will last a long time."

Since 2011 this association has established a contra-fund for possible bad debts, a contingency fund and increased funding for replacement of trees and other landscaping elements. Each of those budget areas is ongoingly and annually funded.

In addition, we've tightened finances via the reserve studies. We have also created the distinction of funding reserves and O&M as truly separate entities. This is a really significant event. Its my opinion that in the past, boards focused on funding O&M so as to meet the cash flow requirements of the next year. I say this because of the condition of O&M budgets and the sorry state of reserves until 2010.

As I have noted in a recent blog post, the annual fee increase required to deal with O&M costs has been modest, about 1.5% per year from 2004 to 2014. The elephant in the room was the reserve contribution via fees, which over the same decade increased about 9% each year. That's where most of the fee increases have gone; to fund reserves. That's also why I have focused on reserve funding. That makes sense, doesn't it? Why agonize over an O&M budget that increases about 1.5% per year when the fees for reserves are actually increasing six times faster per year? But that is difficult to realize unless the budgets are separated. That is precisely why I have done so, and provided that information to everyone. Here is the chart which depicts the data available.

Chart 1:

Recent boards also established a minimum for reserves. On December 2014 this association was projected to have a reserve balance of $590,522, which exceeds the minimum. However, that balance is currently projected to be at least $1.5 million on December 31, 2014. How did that happen? Recent boards have prioritized projects and carefully administered projects. Doing so allowed actual capital expenditures on project completed to come under budget. Some project timetables have been extended, but with little or no discernible detriment. For example, roof replacement has been accelerated and so has drainage improvements, while accomplishing concrete patio, garage floor and driveway replacement, and even an unscheduled street replacement. Entry replacement has been delayed.

Is that a good thing? Well, as the voting owners here at BLMH ran the board off in 2008, What would you expect of a board member after that fiasco? Let's look at it from the perspective of a board member. Would you, as a board member, risk the ire of the entrenched entitlement class at BLMH? That's merely a rhetorical question. I decided I'll do my best, period. We each can, in fact, choose our path in life and live by it.

So, What's the Problem? Why Would Some Board Members Vote to Yet Again Increase Fees?

For the past decade a variety of boards have voted for a more or less continuous series of fee increases which averaged about 4.5% each year. Seems straightforward, doesn't it? However, such an approach has increased the average owner fee at BLMH by about 50%, from $220 per month in 2004 to about $330 in 2014. Over that period, inflation was about 2.28%. My point? The "worst case" fee increase from 2004 to 2014 would have increased owner fees from $220 per month to $282 per month. But boards for several decades underfunded reserves. And that is my real point here. It's easy to make adjustments for one or two year over- or under- funding if one has a savings account and adequate reserves and a bona-fide reserve study.

We have one board member who has been active in the association as a board member for about 37 years, and we have another for 11 years. One of these was deposed in 2008 by owner backlash against fee increases. Board members are human beings and it is painful to be "run off on a rail" after serving on the board for 30+ years. So should we blame a long standing board member for playing it safe and preferring a small incremental fee increase, rather than a fee decrease?

Notes:

1. A few years ago, the board discovered that the replacement fund path this HOA was on would require a roofing project delay. This is supposition on my part, but it is a reasonable explanation for roofing and other project delays. It's my opinion that one of the reasons we have some roofs at BLMH which are nearly 22 years old and have not yet been replaced is because boards made such decisions because of the cash realities. Reserve funding that existed prior to 2010 was problematic. More recently, an issue has included the logistical problems of accelerating the roofing project because of the age of roofs. For example, attempting to replace 8 roofs in 2014, which we did while repaving half of Lakecliffe and a lot of other projects and maintenance repairs. Only five years ago, the board was planning a long term schedule of two roofs a year, which implied a completion in 2024 or so, with some roofs 31 years of age; that's 11 years beyond maximum service life, by the way. Even doing four roofs per year would have extended the project to about 2019, with some roofs 26-27 years old. Some owners who received a new roof early in the queue seemed oblivious to the problem.

2. Related items accomplished included exercising all of the water main shutoffs on the property and preemptively replacing a section of water main before it could fail. That shift from "wait until it breaks" to "we need to take the unprecedented step and address the problem" was a huge shift for the board of this HOA.

3. Of course, when things go wrong those same owners who promote "Keep fees low" and "Take care of my issues" will turn on the board and say "How could you allow this to happen?" or "What are you going to do about this?" I've seen this occur time and time again. It is fortunate that most owners don't practice this approach. But the few are noisy and persistent.

4. I can't state the cause of delinquencies. Some may owe a few pennies, some owners make a rules violation, fail to correct it and are fined. They may delay payment pending a hearing or satisfactory resolution of the violation. Others are simply late by one month's fees. I've attended association meetings for about 8 years. I can say that prior to 2010 the boards seemed reluctant to reveal to owners in the gallery the exact status of delinquencies. This changed in 2010 and the board has since prepared a monthly spreadsheet indicating the number of owners in arrears, the number of owners who owe the association more than $100 and the financial impact on all owners. This is discussed openly with owners in attendance. The identity of those in arrears is only discussed in executive session. It seems the number of owners in arrears began trending upwards after 2007. Not a surprise considering the panic and banking crisis of 2008.

5. Excess and unneeded are two completely different funding matters. Excess funds are those above and beyond planned or anticipated expenditures. Of course, all funds collected will eventually be spent. However, I see no real purpose to charge fees to current owners which accumulate reserves above anticipated requirements. I also have some concern about accumulating fees for capital projects 25 or more years in the future, in particular if they are large amounts. To do so I'd want a much better handle on the real projected costs in 2039-2050. I suppose some could argue that this HOA should plan on saving for entire building replacement in 2050 at the age of 74. It could also be stated that human beings being human beings, a board 10 years in the future might decide to spend what they might consider to be excess funds on some frivolous endeavor. Really long term financial planning (20 and more years into the future) really is a difficult thing to do. I think it does require some balance. How much should current owners contribute to any 2050 plan? That's something boards here will have to really engage in from 2015 and into the future. Don't misunderstand me. I do not advocate this association return to the underfunding habits of the 1980s and 1990s.

6. Operations & Maintenance budgets are intended to be collected and spent in the same year in which collected. That has stressed previous boards. If a board under collects for O&M, it can run out of funds in the calendar year. I've been told that some decades ago this HOA "passed the hat" to cover snow removal bills. With little reserves, it was for good reason boards focused on the O&M budget. I've not doubt that some owners would have pressed for borrowing against reserves if there had been a $million or more in the bank. That's not a good policy. However, focusing on O&M annual budgets is one of the reason boards missed the big picture about reserves. This created the situations where our fee increase attributable to reserves recently went up 30% in one year, then down to a 0% increase the next, and was then followed by another 30% increase. This is not a simple task. But, as I stated in my earlier post "There is a Better Way." It's up to the boards of this HOA to figure this out.

7. It's difficult to change. One or more owners will always show up to quarterback and critique the decisions of the board and management. Some board members may be inclined to keep their head down and only do things when absolutely necessary because no one can ever say the money was spend needlessly.

8. It's sometimes easy to say "let's wait until it breaks." Yes, we really don't know how long those roofs will provide good service. Nor do we know precisely when a failed street will become a "minefield" of potholes. Some take that fact and use it to promote delay. What may blindside owners and even experienced board members is the simple fact that when breakdowns occur, they displace everything else. We don't have unlimited resources and an army of board members, committee members and maintenance workers to throw at these problems when they occur. Nevertheless, there are those who firmly believe this is a good way to run a HOA. To them I say, don't ever change the oil in your car or open the hood. Just drive it and see how far you get and for how long. And, by the way, when it breaks you will be the one to deal with your personal philosophy and this problem. I also say if that's the way one wants to live, then own an apartment or buy a house. You can wait until the roof on your home fails and then fix it in the middle of January. I don't want to gamble with the well-being of others, but I have concluded that we really are a nation of gamblers who take inappropriate risks. Living beyond our means, a failure to think long term and to save for our personal future is really gambling.