|

| Recent years - Leadership makes a difference |

![]()

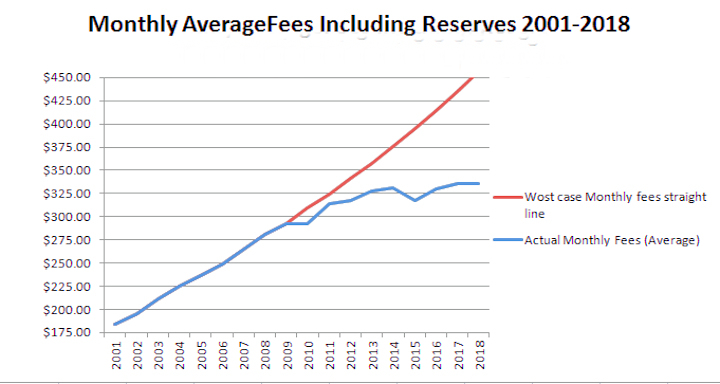

Note: click on images to enlarge. This post will look at the impact of board leadership on owner fees, as well as the disproportionate share of fee increases attributable to funding the Replacement Fund. It will delve into the background of the annual fee increases at BLMH. There are extensive notes in this post, which include supplemental data about fees, annual fee increases, annual Replacement Fund changes, various scenarios and differing approaches, etc. My approach while a board member was to determine overall performance, which necessitated substantial financial review. What I call "number crunching". That approach has substantial benefit to owners.

- Operating Fund [Operations & Maintenance]. This fund is used to account for financial resources available for the general operations of the Association.

- Replacement Fund [Reserves]. This fund is used to accumulate financial resources designated for future major repairs and replacements of the elements the Association has a duty to maintain.

- Member Assessments. Association members [unit owners] are subject to monthly assessments to provide funds for the Association's operating expenses, future capital acquisitions, and major repairs and replacements. Assessments receivable at the balance sheet date represent fees due from unit owners. The Association's policy is to retain legal counsel and place liens on the properties of homeowners whos assessment are significantly delinquent. Any excess assessments at year end are retained by the association for use in the succeeding year. (emphasis mine).

- Annual fees required to fund the Replacement Fund.

- Annual expenditures required to perform identified maintenance in a timely manner via the Reserve Studies and my supplemental reports.

- Extensive and thorough annual on-site condition surveys conducted by management and I, and also sometimes accompanied by the maintenance director.

- From time to time specific guidance would be sought from engineers and specialized contractors.

- Replacement fund balances, year by year.

- Future long term requirements.

- In 2014-2015 the board began an endeavor to turn over the water mains to the City of Wheaton.

- A reserve (Replacement Fund) balance of $984,290 and contribution of $406,900 to the fund in that year.

- A reserve balance of $75,670 and contribution of $484,000 to the fund in that year.

- A reserve balance of $0 and a contribution of $464,799 to the fund in that year.

- The current Replacement Fund balance is about $1,100,000. My chart indicates a possible 2020 year end balance of about $1,050,000 and a 2021 year end balance of about $1,341,000.

- The Operating & Maintenance budget for 2020 was $981,654 according to the data submitted to owners. The chart projected a possible 2020 O&M budget of $941,385.

- The fees assessed per the budget of 2020 were $1,374,692. The scenario below projected fees of $1,341,385 for that year.

- The peak in Replacement Fund spending was anticipated because of the push to complete the Roofing Project before costly failures occurred. It also included the replacement of Lakecliffe as well as other expenditures for driveways, garage floors, etc. Actual annual spending probably did not reach that peak value. The roofing project was anticipated to complete somewhere in 2016-2017.

- Note that the scenario below does not include any surpluses. In fact, budget surpluses did occur in the period depicted in this chart. The boards used projected and actual budget surpluses as part of the budget planning process each year until September 2018. In November, 2018 the board of 2019 did not and chose instead to increase fees. In fact the audit revealed that the O&M surplus for 2018 was $85,163.

- The spreadsheet behind this chart spanned a 30 year period. These spreadsheets were adjusted annually by the boards of 2011-2018 to reflect the current reality. These sheets were tools used by the boards. There were many additional spreadsheets created.

- It is unrealistic to assume that there will be fee increases of 0% each year. In fact, you will see in the chart below that the plan included a fee increase each year. However, budget surpluses if they occur can supplant the requirement or exceed the benefits of modest fee increases. With my departure from the board, the efforts to implement improved cost controls ceased. Those controls are what generated the surpluses with no tricks or alterations to maintenance.

2004 +6.5%

2005 +5.8%

2006 +5.4%

2007 +6.0%

2008 +7.9%

Lake Restoration $15,000

Carpet $5,000

Roof $50,000

Concrete $20,000

Masonry $3,000

Total allocated from fees = $168,000

Lake Restoration $15,000

Carpet $5,000

Roof $160,000

Concrete $35,000

Masonry $25,000

Total allocated from fees = $300,000

According to a verbal statement by the Treasurer, as of September 30, 2021 the amount in the Replacement Fund is now more than $1,100,000. In 2001 that balance was $295,451 and the association, according to my numbers, was facing at least $5,000,000 in backlogged maintenance and the roofing project.

When G and I attended our first HOA meeting early in 2002, we were the only owners present in the audience. By 2006 that audience had swelled to 30 - 50 owners. Why? Because of relentless fee increases and the condition of the property. That's why some owners shouted during meetings "What do we get for our money?" Some owners were frustrated because while the fees increased and the amount in the Replacement Fund grew, the maintenance problems also escalated. The boards seemed reluctant to perform needed maintenance. The plan for the roofing project, when discussed before the owners, was described as something that would be accomplished "at the last possible moment" so as to extract the longest possible life out of the existing roofs. But failures don't occur on schedule and tackling roofing failures that occur in winter is not a good strategy. It was difficult to determine the board's overall plan.

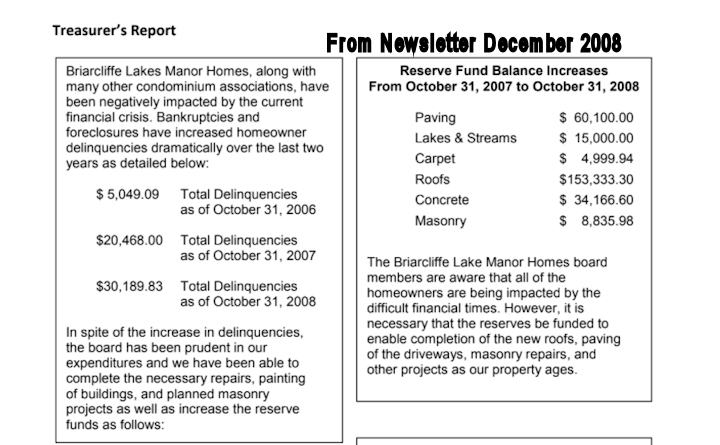

From 2006-2008 boards deflected the owners concerns about the annual fee increases as more and more angry owners attended association meetings. The board promoted these as "small, annual increases". Generally 3 to 5% was discussed and promoted as ideal. But in fact, the fee increases were much larger. (Note 2, 3).

Accumulated fee increases 2001-2018 for Replacement fund = +148%

- 2000 $169 approx. per owner to the replacement fund.

- 2008 $893 approx. per owner.

- 2013 $1,306 approx. per owner.

- 2019 budget approx. $1,182 per owner.

Replacement Fund allocation according to budget numbers released to owners. Bear in mind that these numbers do not include the transfer of O&M surpluses to the Replacement Fund:

- In 2000 the board budgeted about $57,000 to the Replacement Fund ($169 per owner).

- In 2008 the new board allocated $300,000 to the Replacement Fund ($893 per owner) .

- In 2013 the board allocated $438,852 to the Replacement Fund ($1306 per owner). This allocation was 33.7% of the annual budget. That amount was a peak value.

There were no extra-ordinary factors that required these increases. The requirements were normal maintenance. In 2002 The association was 24 years of age and needed street repairs, the roofs were approaching end of life for shingles, streams were in disrepair and so on.

However, even if a 2% inflation factor is used and fees were raised to accommodate the impact on reserves, fees would only increase as a fraction of the budget. Why? because if the reserve contribution is 33% of the annual fees, a 2% increase to the reserves in any given year would be actually a 0.66% annual increase:

- 33% of 2% = 0.66% increase to the total budget.

- A 2% increase to a $330,000 reserve budget requires a $6,600 annual increase.

- A $6,600 fee increase for a $1,352,277 budget is a 0.49% increase.

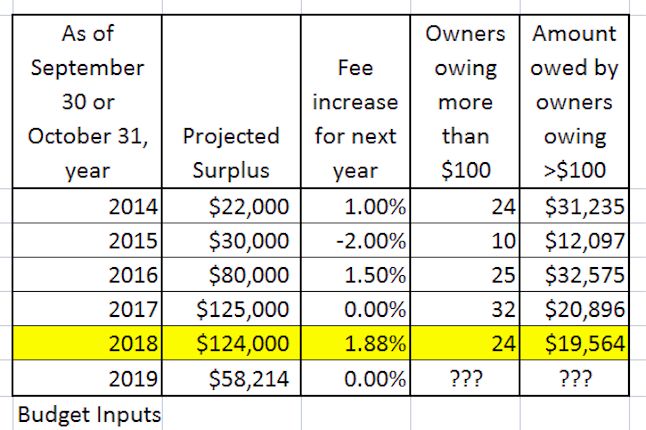

However, if a board can generate surpluses each year, then an annual fee increase may not be necessary. Those surpluses are retained by the association. As noted in an earlier post, $400,000 in surpluses were apparently generated in recent years. Any surplus was passed to the Replacement Fund. For example, using the numbers in the board's annual budgets, these were the projected surpluses as of September-October of each year. The information at that time was used by boards to determine the budget for the following year:

- Projected surplus 2014 $22,000

- 2015 $30,000

- 2016 $80,000

- 2017 $125,000

- 2018 $124,000

- 2019 $58,214

Boards have latitude when determining annual contributions to reserves. Owners will note a baseline amount for the replacement fund in the budget each year plus additions. For example, here is the allocation per the 2019 budget:

- 2012 $440,000

- 2013 $456,000 +3.64% increase

- 2014 $472,000 +3.51% increase

- 2015 $488,000 +3.39% increase

- 2016 $504,000 +3.28% increase

- 2017 $520,000 +3.17% increase

- 2018 $320,000 -38.5% decrease

- 2019 $320,000 +0% increase

- 2020 $320,000 +0% increase

- 2021 $320,000 +0% increase

- 2022 $320,000 +0% increase

- etc.

I'll make the case about how it is very important to separately track O&M expenses, O&M surpluses and Replacement Fund (reserve) contributions. Boards prior to 2008 failed to do so, or if they did, they failed to reveal the details and the motivation for their fee decisions to the owners. They adhered to the minimum legal standard of publishing budgets. The board of 2019-2020 also failed to do so, which is why there was an unnecessary fee increase in the 2019 budget.

In this post I'll be looking specifically at the period 2000-2019.

I could say that the numbers speak for themselves. But if owners are unaware of the numbers and the trends, they can be manipulated. In other words, boards that are unwilling to reveal to owners basic financial information during association meetings are manipulating the owners. Boards that don't reveal the costs of anticipated projects are manipulating owners.

For example, during the annual meeting in September 2021 an owner asked for some simple financial information about the association. The board couldn't answer these simple questions, including the reserve balance. The exasperated owner said "I'll send you an email." It is my understanding that owner has yet to receive an email response from the board, although during the next Zoom meeting of the HOA in October the board did reveal these numbers and some other pertinent numbers. The problem with this approach is most owners don't attend these Zoom online meetings and the information, if presented, is read quickly by the Treasurer.

Owners who cannot attend these meetings are left in the dark. During the Zoom October HOA meeting, only 2% of the owners who are not board members attended the meeting. An association that does not take sufficient steps to include all owners is, in fact, creating separate classes of owners. This is one of the reasons the boards of 2010-2018 took steps to expand the content of newsletters, which were distributed to all onsite owners, offsite owners via US Mail, and posted on the official HOA website.

The Illinois Condominium Act (ILCA) is specific:

| ||

|

The Illinois Condominium Act and the Replacement Fund

The Illinois Condominium Act (ILCA) does have stipulations about reserves. They are to be used "for capital expenditures and deferred maintenance for repair or replacement of the common elements." (Note 6). In other words, the replacement fund should not be used for whimsical, capricious projects that embellish and expand the maintenance costs and owner fees, or move beyond the existing architecture. Maintenance and embellishment are very different. The board is only empowered to maintain the association.

How did boards promote one series of fee increases while enacting much higher fees?

Shortly after I purchased a unit I attended my first board meeting in early 2002. As an owner I attended many meetings from 2005-2010. It was an eye opening, learning experience.

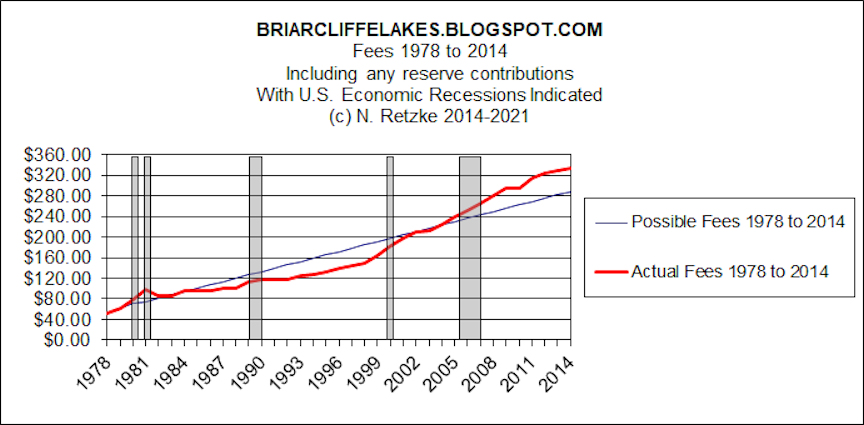

I've included a table in this post showing annual fee increases 1978-2019. I've also included a table of percent changes to Replacement Fund contributions over a period of years.

As I attended meetings I heard board members attempt to explain their philosophy about annual fee increases. I heard it explained that 1) Small annual increases are preferred and 2) Small annual increases can avoid, or prevent special assessments.

Okay, in general that's a wonderful statement to present to owners. But, what is the reality and what steps did boards take to make that "small annual increase" a reality?

The level of annual fee increases proposed by those boards was about 3% per year. As I recall 5% was acknowledged as a peak possibility.

This all seemed reasonable to owners, such as myself. But that is not what happened.

The actual annual fee increases were much higher than that 3%. The annual increases exceeded that 5% peak number for a 11 consecutive years, and peaked at 11.0% for two consecutive years, 1999 and 2000.

I don't know what boards told owners prior to 2002, because I wasn't at BLMH. I do know what transpired from 2002 to 2019. Furthermore, the reserve study of 2010 recommended a special assessment in addition to to a large fee increase. That recommendation and a 10% fee increase was despite all of the pap to owners by earlier boards about how moderate 3% annual fee increases will avoid special assessments.

==

As a mere owner I attended a lot of association meetings. The board always discussed small annual fee increases, but declined to discuss during open meetings the fact that the elephant in the room was the condition of reserves. In fact, the budget meetings were not open meetings until 2008 or so.

I pointed out to anyone who would listen that the real problem at BLMH was the condition of the replacement fund and the project/maintenance backlog. I was ignored. Boards continued to promote small 3% annual fee increases as preferred to special assessments. However, a 3% annual increase could not pay for the roofing project.

Annual fee increases may grow the Replacement Fund. One might say that there are benefits to the association. Owners, however, see the cost of living in the HOA increase.

Is there a benefit to owners? If the board continues to maintain the association there is. However, repairs may be deferred or delayed in an attempt to increase the amount held in the Reserves. Prior to 2011 this is the situation the association was in, according to my condition surveys and the numbers. The numbers and condition reports I made as an owner prior to 2010 indicated that the board was accruing funds for the roofing project, and deferring other needed maintenance. In such circumstances property values may be reduced, or may not keep pace with the values in the neighborhood.

Keep in mind that association elections occur in September, and the board determines the budget and owner fees in October-November. In other words, the fees for 2015 were decided in October-November of 2014. I've included figures for the average and total fees during the tenure of recent board presidents. Bold years below are the years I was on the board. S. LaFortune, a CPA, was on the board 2010-2015 (thanks to my enrollment of him). When I joined the board I had nearly 4 decades of business and upper management experience (CEO and President).

Year - Percent Change - board president

- 2001 +9.0 S. Bailey

- 2002 +6.0 S. Bailey

- 2003 +7.9 S. Bailey

- 2004 +6.5 S. Bailey

- 2005 +5.8 S. Bailey

- 2006 +5.4 S. Bailey

- 2007 +6.0 S. Bailey

- 2008 +5.5 S. Bailey (average 6.46% per year, +51.7% total)

- 2009 +5.1 J. Holben

- 2010 0.0 L. Richmond

- 2011 +7.0 S. LaFortune

- 2012 +3.0 S. LaFortune

- 2013 +2.0 S. LaFortune

- 2014 +1.0 S. LaFortune

- 2015 -2.0 S. LaFortune (average 3.0% per year, +15.0% total)

- 2016 +1.5 N. Retzke

- 2017 +1.5 N. Retzke

- 2018 0.0 N. Retzke (average 1.0% per year, +3.0% total)

- 2019 +1.88% S. Bailey

That is how I know the dollar amount and the percentage of the budget allocated to the Replacement Fund, year by year. This is also how I know why boards promoted one level of fees to owners while enacting budgets with much higher fees.

Before continuing with some numbers, I need to say a few things about them. Some board members had difficulty comprehending this: 1) A change of 0.00% means that the contribution was identical to the previous year. However, the previous years increases will continue to accumulate. 2) A change of 100% means that the contribution was double that of the previous year and that too will continue, indefinitely. 3) In 2001 the board budgeted about $57,000 to the Replacement Fund. 4) In 2008 the new board allocated $300,000 to reserves. That's about three times the allocation in 2001, when I purchased. (Note 5).

If you compare the Replacement Fund contribution percentage to fees, you will see that contributions to the Replacement Fund increased substantially each year over the period.

You will notice two things. 1) Contributions to the Replacement Fund increased by a much larger percentage each year than did the overall fee increases passed by the board and extracted from owners (Note 2 and 3), and 2) Fee increases were largely due to the board's decisions to increase the contributions to the Replacement Fund.

Had boards communicated this fact in 2000-2010, expressed the amounts required for major maintenance and done a bit more work to build the replacement fund and stabilize fees, the large overall fee increases during my ownership 2002-2011 might have not been so great and owners might not have been so angry 2006-2008. The following chart shows how boards decided to skimp on building the replacement fund and then switched. It was too late and owners got large fee increases and the bonus of the 2007-2009 Great Recession and all of the related financial carnage:

|

| Fee Analysis 2014 Had Boards from 1984 to 2006 done a better job of planning the budgets Owner fees would have been substantially lower 2005-2014 |

Please be aware that these increases ignore any O&M surpluses which were transferred into the Replacement Fund. Year end budgets indicated that from 2009-2018 those surpluses may have totaled $439,000. Of course, these are unaudited numbers because the numbers are from official, annual, association budgets. Those budgets wee used by boards to set fees, etc. and they indicated the projected budgets and surpluses as of December 31 of each year. It is to be acknowledged that the accrued surpluses during the 6-year period prior to 2019 may have provided the equivalent of an additional year's contribution to the Replacement Fund.

In other words, the annual contribution to the Replacement Fund by owners via their fees, during the period 2009-2018, may have been more than 12% greater than called for by the budgets passed by the boards.

Yet, during the discussions held during the budget meeting in Fall of 2015, there were recriminations by one board member against others because our HOA fees weren't high enough. (Note 3).

Replacement Fund Changes, by year

Percent change to Replacement Fund (reserve) contributions, each year:

- 2001 +9.00%

- 2002 +100.00%

- 2003 +5.06%

- 2004 +7.15%

- 2005 +9.19%

- 2006 +22.92%

- 2007 +9.06%

- 2008 +12.03%

- 2009 +9.09%

- 2010 0.00%

- 2011 +22.9% (with reserve study data)

- 2012 0.0% (with additional reserve study data)

- 2013 +4.81%

- 2014 +0.64%

- 2015 +5.03%

- 2016 +2.48%

Upon achieving a position on the board after September 2010 I provided my conclusions about the fees compared to the funding of Reserves to the Boards. Each board member could have run their own numbers each and every year. I did give my charts, etc. to the board and while on the board I did discuss this thoroughly and completely with the entire board.

The O&M budget is one year in duration and has short term implications for owners. Ideally, all money in the O&M budget will match the expenses of that calendar year. Because it is undesirable for expenses to exceed the budget. it is prudent to construct an O&M budget which can achieve a small year-end surplus.

The Replacement Fund (reserves) budget is designed to deal with long term maintenance of the association. This budget is to provide funds required by the board using the Reserve Studies. Those studies are very long term, and look 40 years into the future.

In fact, prior to 2010 this association never had an independently prepared Reserve Study. That may explain some of the fee increases 1984-2009. Without the benefit of very long term, complete studies with 50+ categories and detailed condition reports, the boards operate using a more short-sighted approach. There is a tendency to collect fees for the Replacement Fund determined by short term maintenance requirements with little consideration of expenditures more than 5 years into the future.

Here is a summary of my experience 2001-2010: When the Sword of Damocles is swung over their heads the board may react; some board members will depart. Fees may be ramped up when boards realize that the amount in the Replacement Fund is insufficient to meet the needs of the next 5-10 years, particularly if there is a single, large project such as the roofing project to be done. For owners, the problem is that reactionary boards, when confronted with a greater than $1million project will simply raise fees each year to raise sufficient funds for that specific project. That's what happened 2000-2008. However, those boards continued to talk about 3% annual fee increases. Obviously, $1 million or more can't be raised in 5 years with an annual Replacement Fund contribution of $108,000. One projection indicated the roofing project could require about $2,200,000 or more.

To shed some light on what the board was doing I separated these categories, O&M and Replacement Fund to get a better understanding of the operation of BLMH. I tracked the amounts and percentage increase and the percentage of the budget for each in a spreadsheet, year by year.

That is how I know the dollar amount, the percentage of the budget allocated to the Replacement Fund, and the percentage increase budgeted to the fund year by year.

In doing so and by simply adding up the costs to replace a driveway, or a garage floor, or a roof, I was able to get a much better understanding of short term (10-year) expenditures facing this association. The board did not reveal these numbers to owners.

In doing so, I also got a better picture of what the board was actually doing with those annual fee increases.

I would suggest that if O&M surpluses occur, the board should pay closer attention to the fees required for the Replacement Fund. In my experience, many boards ignore and don't comprehend the consequences. They ignore surpluses, and pretend there simply isn't sufficient money. Oh, and lets keep owner paying for water main repairs, etc. These things will certainly demonstrate that fees need to be increased much higher.

Year, after year, after year, simply raise fees. They are their own worst enemies, and the owners pay, literally.

And of course, the owners will pay because the board will raise the fees, and paying fees is a rule in the association. The owners have no choice after electing a board which provided pap in their Candidates Form.

Notes

1. Over the years, boards have used a number of different resources for determining the annual allocation to the replacement fund. Prior to 2010 management was the source. To determine replacement fund requirements it is essential to note the condition of the property, as well as the actual amount in reserves as well as the addition, year by year.

Some boards kicked the can down the road. Delays simply pass the costs into the future.

Boards from 2009-2018 used several professional sources, other than management, for determining reserve requirements. The studies completed from 2010 - 2018 included 40 years of maintenance. For example, in 2011 the study included annual expenditures for the period 2012 to 2041. Those expenditures were broken into 37 categories. A funding plan was constructed for that same period. The funding plan provides a framework for determining annual fees to be allocated to the Replacement Fund. Of course, boards can adjust the time frame for maintenance and also the fee structure. If a board chooses to do so, adjustments must be made to a variety of spread sheets to determine the consequences for both current and future owners.

For those who are inclined to blindly follow the experts I do want to point out that the plan in one study resulted in very low reserves. How low? $75,670 in 2016 and $87,480 in 2017. The boards I was on chose another approach and decided that $450,000 was a minimum acceptable level. To do this required that I build additional spread sheets and present alternative funding plans and expenditure plans to the board. This was done several years in succession, as projects progressed and were completed. I printed and pasted together spread sheets marked for discussion during open association meetings. S. LaFortune, a CPA, was president during one of these periodic reviews. In fact, the reserves were maintained above $600,000 and yet all the goals were achieved.

The Illinois Condominium Act (ILCA) states that an association can only have one class of owners. I always took a view that to kick the can down the road did create separate classes. The current owners would be a class with lower fees, and future owners would be another class, and would be penalized with substantially higher fees.

It takes a lot of work to determine present costs and the condition of the association, and then determine future costs and design a 40-year maintenance plan. That plan will change year by year. It took me more than 1,000 hours in my first year on the board. I was also working full time. However the association had serious financial issues during the great recession and owners were foreclosing and going into bankruptcy. I viewed each day that transpired as another nail in the financial coffin of owners. The bleeding had to stop, and the course reversed. In total, I expected this would require 10 years to complete the current maintenance phase. Turnover of the water mains to the city would be a necessity. These challenges were considered to be impossible, by some. I attribute that to their lack of skill and knowledge and inability to prioritize and put in what was necessary to accomplish this task. Board lack of vision and active undermining is why I left that board in September 2018.

I also began serious, annual reviews of all expenditures; any O&M savings is passed into the Replacement fund. However, I did not want to repeat the mistakes of earlier boards and delay maintenance. The challenge, rather, was to identify all cost centers and manage each of them. The Board in 2010 did discuss an austerity program and contingency plan. This included turning off the streams. However, because those streams are a major architectural feature it was designed to replace a failed pump while making a long term plan to repair the streams. The poor condition of streams contributed to excess water usage and owner fees pay for each gallon used. Obviously, repairing streams and reducing water usage would reduce that cost in the Operations & Maintenance (O&M) budget. To aid in accomplishing this I took many photos and made a video of the condition of the concrete in some severely damaged stream sections. These were shown to the board and became an integral part of the discussions about where and when to do repairs. In fact, major repairs to all streams were completed by 2018. However, there are still some areas requiring repairs.

In 2010 upon achieving a seat on the board I made my own study and constructed a series of spreadsheets which detailed the funding plan and expenditures necessary to complete the roofing project, driveways, garage floors, and Lakecliffe street replacement. That plan recognized the issues with the streams and other common elements and spanned 2011-2041. To my knowledge I am the only board member to have ever done this. However, Lisa Richmond, who was president in 2010 also created a number of spreadsheets. Her 2010 sheet included all budget categories. I volunteered to assist her in this endeavor, but she proceeded alone. In reading it I saw $65,938 for a plumber to deal with two water main repairs. These numbers were all gleaned from monthly management reports provided to all board members. But some board members don't comprehend the numbers or retain the information provided in the reports. Which is why spreadsheets and historical charts are so very useful.

2010 is when I began an initiative to turn the water mains over to the city of Wheaton. It was my sole initiative and one board member actively enrolled other board members in the "impossibility" of doing this. Which is why, as of the date of the post, this transition has not yet occurred. All the pieces were in place three years ago. LOL.

Here are some charts published at this blog and presented to owners during an association meeting:

|

| 2010 Roofing Project Plan that I constructed |

|

| Several charts from Replacement Fund cash flow and funding plan that I designed |

My information was incorporated into the professionally prepared reserve study of 2011. That study included extensive site surveys and condition reports. These were conducted by the professional firm and by management and I.

Actual costs to replace the water mains would require an engineering study, and with that proposals to accomplish the replacement in phases over a number of years. My numbers are based upon reserve studies and actual repair costs, which are less precise.

2. When the newsletters were expanded not all board members were in favor of doing so. In fact, one board member argued against. Her argument was "Most owners don't read the newsletter." The counter argument was "It is the board's responsibility to inform and provide the information to owners. What they do with the newsletter after they receive it is not the board's responsibility." Once I left the board, the newsletters reverted to the minimalistic information preferred by that board member.

In 2010 not all owners were pleased with the expanded newsletter. I am aware of several complaints by owners who preferred the association be run as a "Neighbors Club" with a social newsletter, rather than a business one.

3. G and I interviewed owners at the time we were considering a purchase in 2001. There was a consensus among them that the recent fee increases were an issue: Here's the numbers for three years that led owners to that conclusion:

- 1999 +11.0%

- 2000 +11.0%

- 2001 +9.0%

We studied the financial documents including the Balance Sheet and Budget. We did this after we tendered an offer. It is one of the oddities that this was not made available to us until after we made a commitment. We realized that reserves were inadequate, and I spotted maintenance shortcomings as we walked the property. I told G 1) Be prepared for many years of larger than normal fee increases and 2) Be prepared for fireworks among the owners.

By 2006 there was a large group of very unhappy owners.

4. A table of fee increases, by year. Note that budgets and fees are determined by the board during a budget meeting held normally in October. In other words, the budget for 2019 was determine by the board elected in September 2018. I included some notes. For example, a reserve study in 2010 impacted the budget and fees of 2011. I departed the board as of September 28, 2018. Owners are allowed to comment on budgets prior to formal vote and passage by the board, but the board is under no obligation:

Year and Percent Fee Change

- 1978 +35.0

- 1979 +22.0

- 1980 +26.0

- 1981 +25.0

- 1982 -12.0

- 1983 0.0

- 1984 +10.0

- 1985 0.0

- 1986 0.0

- 1987 +5.0

- 1988 0.0

- 1989 +12.0

- 1990 +5.0

- 1991 0.0

- 1992 0.0

- 1993 +6.0

- 1994 +3.0

- 1995 +4.0

- 1996 +5.0

- 1997 +3.0

- 1998 +3.0

- 1999 +11.0

- 2000 +11.0

- 2001 +9.0

I purchased a unit in February 2002, so this was my experience:

- 2002 +6.0

- 2003 +7.9

- 2004 +6.5

- 2005 +5.8

- 2006 +5.4

- 2007 +6.0

- 2008 +5.5

- 2009 +5.1 (New board September, new 2010 budget)

- 2010 0.0 (I joined the board September 2010, after completion of reserve study)

- 2011 +7.0 (First reserve study used to determine; study flawed)

- 2012 +3.0 (Subsequent reserve study used)

- 2013 +2.0

- 2014 +1.0

- 2015 -2.0 (Updated reserve study)

- 2016 +1.5

- 2017 +1.5

- 2018 0.0 (my last year on the board)

5. I've completed course work about our relationship to money and have been a paid financial writer. On a personal level, we will either succeed or fail in our financial endeavors. We will then bring all of our baggage to the board when we achieve status as a board member. Fiduciaries should check that baggage at the door. But my experience is that more than a few cannot do this.

For some on the board, who can afford fee increases, budgeting will be about the impact on their personal lifestyle, which is nil. The lens is "I can afford a fee increase". For others on the board who are struggling financially, doing budgeting and determining fees may be through a more personal lens "Can I afford this?". Neither group may be able to operate in the capacity of a fiduciary.

6. Numbers provided here are from information provided via budgets, or gleaned from boards as a mere owner by observing association meetings and taking notes.

7. I observed the board spend about a third of the time spent during meetings discussing work orders in the monthly packet provided by management.

Work Orders are observed maintenance issues on the property, or specific owner requests, such as "I want a tree". When an issue is determined a work order is issued to Maintenance, to Landscaping, or to the plumber, etc. Some are flagged for board discussion, so that direction may be given to management, but many are automatic.

Each monthly packet given to the board included two groups of work orders, "Open" or in progress and "Closed" or completed.

In order to streamline the meetings and come better prepared, the Management went so far as to request, in writing on a monthly basis, that Board Members send him their questions "In advance of the meetings."

But one board member refused to do this, steadfastly spending up to an hour of the meeting on discussing any and all work orders.

As president I asked the Maintenance Director to prepare a summary each month. That summary gave statistics such as number of open orders, the number allocated to Landscaping, to Maintenance and so on. The Maintenance Director flagged orders for further discussion and provided status reports as to how some were resolved. This did streamline the process, management was given an opportunity to better prepare, and banter was reduced.

However, my actions created additional enmity and rancor among some on the board. There's an old expression "No good deed goes unpunished."

8. For example, during the budget meeting held in the fall of 2018 the president promoted a fee increase. However, the budget numbers indicated a large surplus was achieved in the prior year. Even though it was in plain sight, that surplus was ignored when discussing the budget. When it was time to vote, a board member asked the president "Is a fee increase necessary?" and the president responded "Absolutely". The entire board then voted for the 1.88% fee increase. Any surplus was automatically passed to the Replacement Fund. There was no mention of this during that budget meeting, nor were the reserve balance cited as inadequate during that meeting.

I sent a stern email to management to be given to that board. It was an angry and stern email about their decision.

This is why I left the board. It is impossible to work with some board members who operate on opinions and ignore the facts.

9. The Illinois Condominium Act provides stipulations to boards regarding budgets and reserves. The ILCA includes considerations to be give by boards when considering budgets. Regarding the Replacement Fund the ILCA stipulates that the board determined reserves are to be reasonable and the board is to consider "(iv) the financial impact on unit owners, and the market value of the condominium units, of any assessment increase needed to fund reserves; and (v) the ability of the association to obtain financing or refinancing." (emphasis mine):

(765 ILCS 605/9) (from Ch. 30, par. 309) Sec. 9. Sharing of expenses - Lien for nonpayment.

2) All budgets adopted by a board of managers on or | ||

|

10. Illinois Condominium Act pertaining to providing owners with financial documents beyond the annual budget and making these available to owners. I'll post more on this later:

(765 ILCS 605/9) (from Ch. 30, par. 309) (Text of Section after amendment by P.A. 102-162) Sec. 18. Contents of bylaws. The bylaws shall provide for at least the following................

|

(765 ILCS 605/19) (from Ch. 30, par. 319) Sec. 19. Records of the association; availability for examination. (a) The board of managers of every association shall keep and maintain the following records, or true and complete copies of these records, at the association's principal office: (1) the association's declaration, bylaws, and plats | of survey, and all amendments of these; |

(2) the rules and regulations of the association, if | any; |

(3) if the association is incorporated as a | corporation, the articles of incorporation of the association and all amendments to the articles of incorporation; |

(4) minutes of all meetings of the association and | its board of managers for the immediately preceding 7 years; |

(5) all current policies of insurance of the | association; |

(6) all contracts, leases, and other agreements then | in effect to which the association is a party or under which the association or the unit owners have obligations or liabilities; |

(7) a current listing of the names, addresses, email | addresses, telephone numbers, and weighted vote of all members entitled to vote; |

(8) ballots and proxies related to ballots for all | matters voted on by the members of the association during the immediately preceding 12 months, including, but not limited to, the election of members of the board of managers; and |

(9) the books and records for the association's | current and 10 immediately preceding fiscal years, including, but not limited to, itemized and detailed records of all receipts, expenditures, and accounts. |

(b) Any member of an association shall have the right to inspect, examine, and make copies of the records described in subdivisions (1), (2), (3), (4), (5), (6), and (9) of subsection (a) of this Section, in person or by agent, at any reasonable time or times, at the association's principal office. In order to exercise this right, a member must submit a written request to the association's board of managers or its authorized agent, stating with particularity the records sought to be examined. Failure of an association's board of managers to make available all records so requested within 10 business days of receipt of the member's written request shall be deemed a denial. Any member who prevails in an enforcement action to compel examination of records described in subdivisions (1), (2), (3), (4), (5), (6), and (9) of subsection (a) of this Section shall be entitled to recover reasonable attorney's fees and costs from the association. (c) (Blank). (d) (Blank). (d-5) As used in this Section, "commercial purpose" means the use of any part of a record or records described in subdivisions (7) and (8) of subsection (a) of this Section, or information derived from such records, in any form for sale, resale, or solicitation or advertisement for sales or services. (e) Except as otherwise provided in subsection (g) of this Section, any member of an association shall have the right to inspect, examine, and make copies of the records described in subdivisions (7) and (8) of subsection (a) of this Section, in person or by agent, at any reasonable time or times but only for a purpose that relates to the association, at the association's principal office. In order to exercise this right, a member must submit a written request, to the association's board of managers or its authorized agent, stating with particularity the records sought to be examined. As a condition for exercising this right, the board of managers or authorized agent of the association may require the member to certify in writing that the information contained in the records obtained by the member will not be used by the member for any commercial purpose or for any purpose that does not relate to the association. The board of managers of the association may impose a fine in accordance with item (l) of Section 18.4 upon any person who makes a false certification. Subject to the provisions of subsection (g) of this Section, failure of an association's board of managers to make available all records so requested within 10 business days of receipt of the member's written request shall be deemed a denial; provided, however, that the board of managers of an association that has adopted a secret ballot election process as provided in Section 18 of this Act shall not be deemed to have denied a member's request for records described in subdivision (8) of subsection (a) of this Section if voting ballots, without identifying unit numbers, are made available to the requesting member within 10 business days of receipt of the member's written request. Any member who prevails in an enforcement action to compel examination of records described in subdivision (7) or (8) of subsection (a) of this Section shall be entitled to recover reasonable attorney's fees and costs from the association only if the court finds that the board of directors acted in bad faith in denying the member's request. (f) The actual cost to the association of retrieving and making requested records available for inspection and examination under this Section may be charged by the association to the requesting member. If a member requests copies of records requested under this Section, the actual costs to the association of reproducing the records may also be charged by the association to the requesting member. (g) Notwithstanding the provisions of subsection (e) of this Section, unless otherwise directed by court order, an association need not make the following records available for inspection, examination, or copying by its members: (1) documents relating to appointment, employment, | discipline, or dismissal of association employees; |

(2) documents relating to actions pending against or | on behalf of the association or its board of managers in a court or administrative tribunal; |

(3) documents relating to actions threatened against, | or likely to be asserted on behalf of, the association or its board of managers in a court or administrative tribunal; |

(4) documents relating to common expenses or other | charges owed by a member other than the requesting member; and |

(5) documents provided to an association in | connection with the lease, sale, or other transfer of a unit by a member other than the requesting member. |

(h) The provisions of this Section are applicable to all condominium instruments recorded under this Act. Any portion of a condominium instrument that contains provisions contrary to these provisions shall be void as against public policy and ineffective. Any condominium instrument that fails to contain the provisions required by this Section shall be deemed to incorporate the provisions by operation of law.(Source: P.A. 100-292, eff. 1-1-18; 100-863, eff. 8-14-18.)

11. The Illinois Condominium Act pertaining to a board's failure to provided documents when asked:

(b) Any member of an association shall have the right to inspect, examine, and make copies of the records described in subdivisions (1), (2), (3), (4), (5), (6), and (9) of subsection (a) of this Section, in person or by agent, at any reasonable time or times, at the association's principal office. In order to exercise this right, a member must submit a written request to the association's board of managers or its authorized agent, stating with particularity the records sought to be examined. Failure of an association's board of managers to make available all records so requested within 10 business days of receipt of the member's written request shall be deemed a denial. Any member who prevails in an enforcement action to compel examination of records described in subdivisions (1), (2), (3), (4), (5), (6), and (9) of subsection (a) of this Section shall be entitled to recover reasonable attorney's fees and costs from the association.

12. Illinois Condominium Act pertaining to open meeting requirements:

(Text of Section after amendment by P.A. 102-162) Sec. 18. Contents of bylaws. The bylaws shall provide for at least the following:

(9)(A) that every meeting of the board of managers | ||

|

13. Click for Illinois Condominium Act

(C) N. Retzke