As 2017 comes to an end, it has been another year of fun on the board at BLMH.

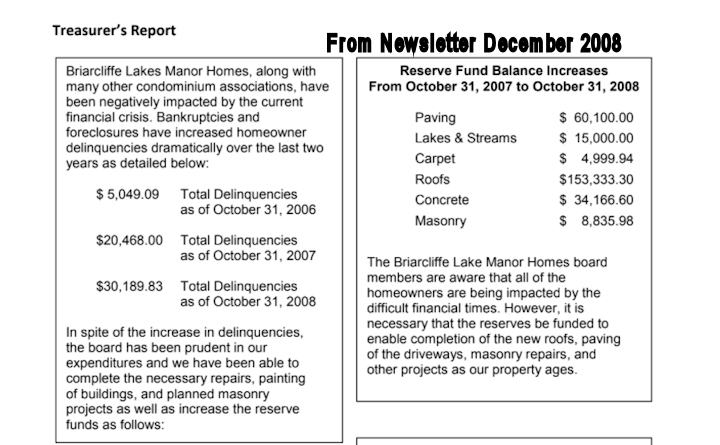

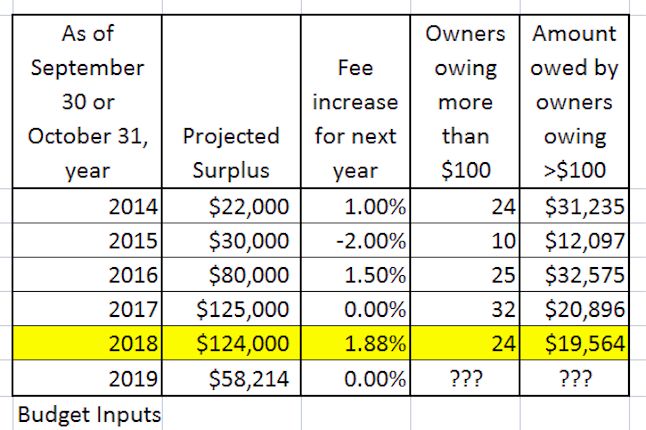

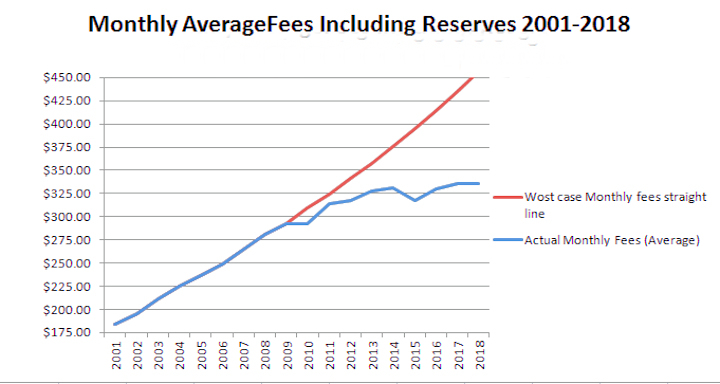

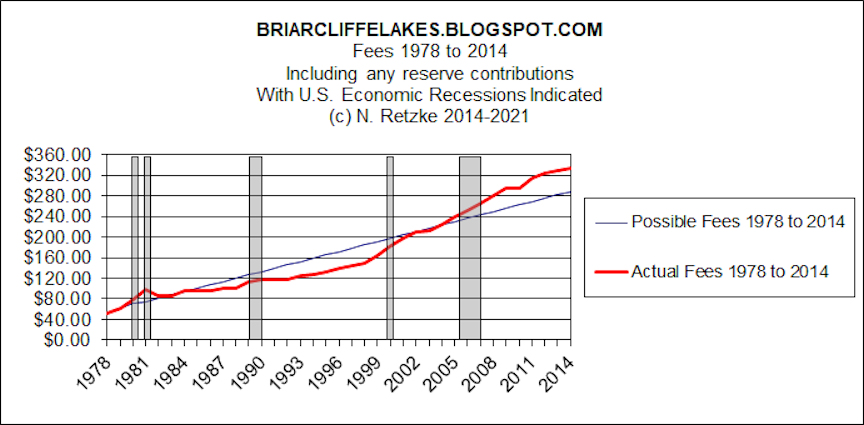

The board tackled one of three stream segments this year and completed a common area deck which had begun in 2013. Both of these projects actually atrophied for more than a decade. Earlier boards went for large, visible projects such as the re-roofing, but couldn't do much of anything else because they or their predecessors had failed to save.

Turning our Titanic around has had its fun moments. I'm not a proponent of spending money on flashy projects, so under my watch it has been primarily about dealing with the crisis and breakdowns created by others. Doing so has been as much a grind as it has been a party. However, it can be satisfying to see others live in their cone of impossibility and then show then how really stupid they have been. They'll never learn of course, so after three years of trying I stopped. Much better and more satisfying to deal with REAL problems instead of the personal agendas of others.

I think this demonstration is just about over and has run its course.

We now have two boards. One forward thinking and forward looking and the other mired in the past.

I did complete my 2018 project list and I have completed the estimates for their cost. Meanwhile the "Henny Penny" is still fighting be battles of a decade ago. Too bad they are so little and so late. The owners could have been spared a lot of pain with a little timeliness.

I'll probably publish the project list in February 2018. Whatever happens will be determined by the entire board. There will be some stonewalling of course. If you can't build anything then perhaps all that one can do is tear down anything and everything around them.

Being on the board since 2010 has brought back some fond memories. I was one of a large number of children. When it came to doing chores, or anything they didn't want to do, some of the siblings had be dragged kicking and screaming all of the way. Boards are like that!